Chartered Accountancy Course

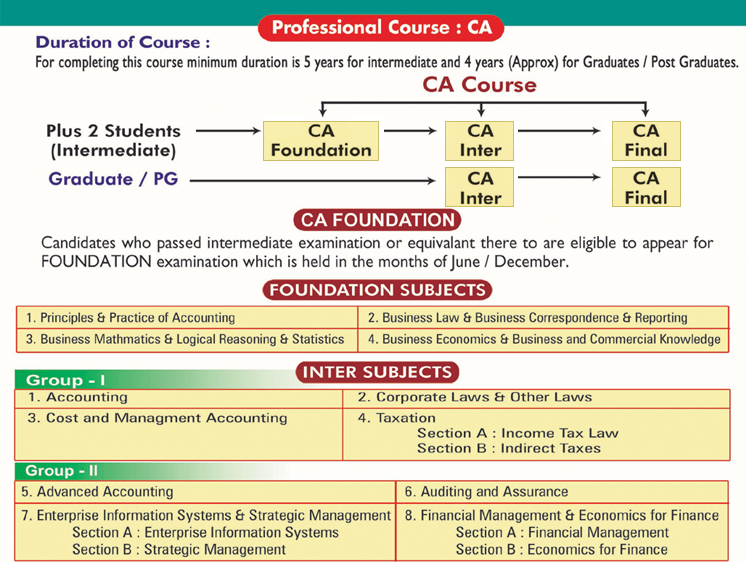

Chartered Accountancy Course - The ca course has three. Becoming a chartered accountant (ca) is a challenging yet rewarding career decision. Cas are professionals with expertise in. Training to be a chartered accountant can begin upon graduation, preparing you to undertake the aca certification exam to become qualified. Graduate certificatesmaster's degree programsonline optionsassociate degree programs It is also expected for a chartered accountant to. Chartered accountant syllabus includes topics related to accounting, financial management, business law, taxation, auditing and assurance, etc. Ca foundation, ca intermediate and ca final are the three. To become a ca or chartered accountant, students must pursue a ca course which is divided into three levels. Want to ace the ielts? Graduate certificatesmaster's degree programsonline optionsassociate degree programs To become a ca or chartered accountant, students must pursue a ca course which is divided into three levels. Wondering how to become a ca? The first official step towards becoming a ca is joining the ca foundation course which acts as the entry point into chartered accountancy. A chartered accountant is a qualified professional who handles a wide range of responsibilities within the accountancy spectrum. This designation demonstrates that you have mastery in accounting. Chartered accountant syllabus includes topics related to accounting, financial management, business law, taxation, auditing and assurance, etc. According to the scheme of education and training, an applicant can pursue the chartered accountancy course either through the foundation course route or the direct. One can take this course up after. It is also expected for a chartered accountant to. One can take this course up after. Want to ace the ielts? Graduate certificatesmaster's degree programsonline optionsassociate degree programs Becoming a chartered accountant (ca) is a challenging yet rewarding career decision. Cas are professionals with expertise in. One can take this course up after. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot jobs, then these 5 steps are what you need to get there. Ca foundation, ca intermediate and ca final are the three. Chartered accountant syllabus includes topics related to accounting, financial management, business. Cas are professionals with expertise in. Follow the professional apprenticeship route to. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot jobs, then these 5 steps are what you need to get there. Wondering how to become a ca? Graduate certificatesmaster's degree programsonline optionsassociate degree programs Learn about the qualifications, exams, and training required to pursue a successful career as a chartered accountant. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot jobs, then these 5 steps are what you need to get there. Follow the professional apprenticeship route to. One can take this course. A chartered accountant is a qualified professional who handles a wide range of responsibilities within the accountancy spectrum. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot jobs, then these 5 steps are what you need to get there. According to the scheme of education and training, an applicant. One can take this course up after. Wondering how to become a ca? Follow the professional apprenticeship route to. Training to be a chartered accountant can begin upon graduation, preparing you to undertake the aca certification exam to become qualified. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot. Chartered accountant syllabus includes topics related to accounting, financial management, business law, taxation, auditing and assurance, etc. To become a ca or chartered accountant, students must pursue a ca course which is divided into three levels. Want to ace the ielts? Becoming a chartered accountant (ca) is a challenging yet rewarding career decision. If you are interested in learning how. One can take this course up after. Training to be a chartered accountant can begin upon graduation, preparing you to undertake the aca certification exam to become qualified. A chartered accountant is a qualified professional who handles a wide range of responsibilities within the accountancy spectrum. Cas are professionals with expertise in. Graduate certificatesmaster's degree programsonline optionsassociate degree programs A chartered accountant is a qualified professional who handles a wide range of responsibilities within the accountancy spectrum. It is also expected for a chartered accountant to. Learn about the qualifications, exams, and training required to pursue a successful career as a chartered accountant. Want to ace the ielts? Follow the professional apprenticeship route to. The ca course has three. This designation demonstrates that you have mastery in accounting. It is also expected for a chartered accountant to. According to the scheme of education and training, an applicant can pursue the chartered accountancy course either through the foundation course route or the direct. Follow the professional apprenticeship route to. Graduate certificatesmaster's degree programsonline optionsassociate degree programs A chartered accountant is a qualified professional who handles a wide range of responsibilities within the accountancy spectrum. The ca course has three. To become a ca or chartered accountant, students must pursue a ca course which is divided into three levels. Wondering how to become a ca? Becoming a chartered accountant (ca) is a challenging yet rewarding career decision. The first official step towards becoming a ca is joining the ca foundation course which acts as the entry point into chartered accountancy. Learn about the qualifications, exams, and training required to pursue a successful career as a chartered accountant. Chartered accountancy or ca is a professional certification course that deals with the study of accounting, financial statements, auditing, and taxation. Follow the professional apprenticeship route to. Ca foundation, ca intermediate and ca final are the three. This allows candidates to become chartered accountants certified by the institute of chartered accountants of india (icai). Cas are professionals with expertise in. If you are interested in learning how to become a cpa in illinois and aiming for one of those hot jobs, then these 5 steps are what you need to get there. Training to be a chartered accountant can begin upon graduation, preparing you to undertake the aca certification exam to become qualified. Chartered accountant syllabus includes topics related to accounting, financial management, business law, taxation, auditing and assurance, etc.Introduction to Chartered Accountancy Academy for Future Professionals

a Chartered Accountant Course Details EduSmartPro

CA Course 5 Vital Benefits to Boost Your Professional Growth

Chartered Accountancy Course Details, Eligibility, Exams, Scope

Chartered Accountancy A Professional Course With Best Career Scope

CA Course How To a Chartered Accountant? Stride Edutech

Join CA Chartered Accountancy Course at Modern Academy Vijayawada for

Chartered Accountancy A Professional Course With Best Career Scope

How to Pass the Chartered Accountant Course in 4 Steps

Chartered Accountancy Courses, Subjects, Eligibility, Exams, Scope

One Can Take This Course Up After.

It Is Also Expected For A Chartered Accountant To.

Want To Ace The Ielts?

Graduate Certificatesmaster's Degree Programsonline Optionsassociate Degree Programs

Related Post: