Credit Risk Course

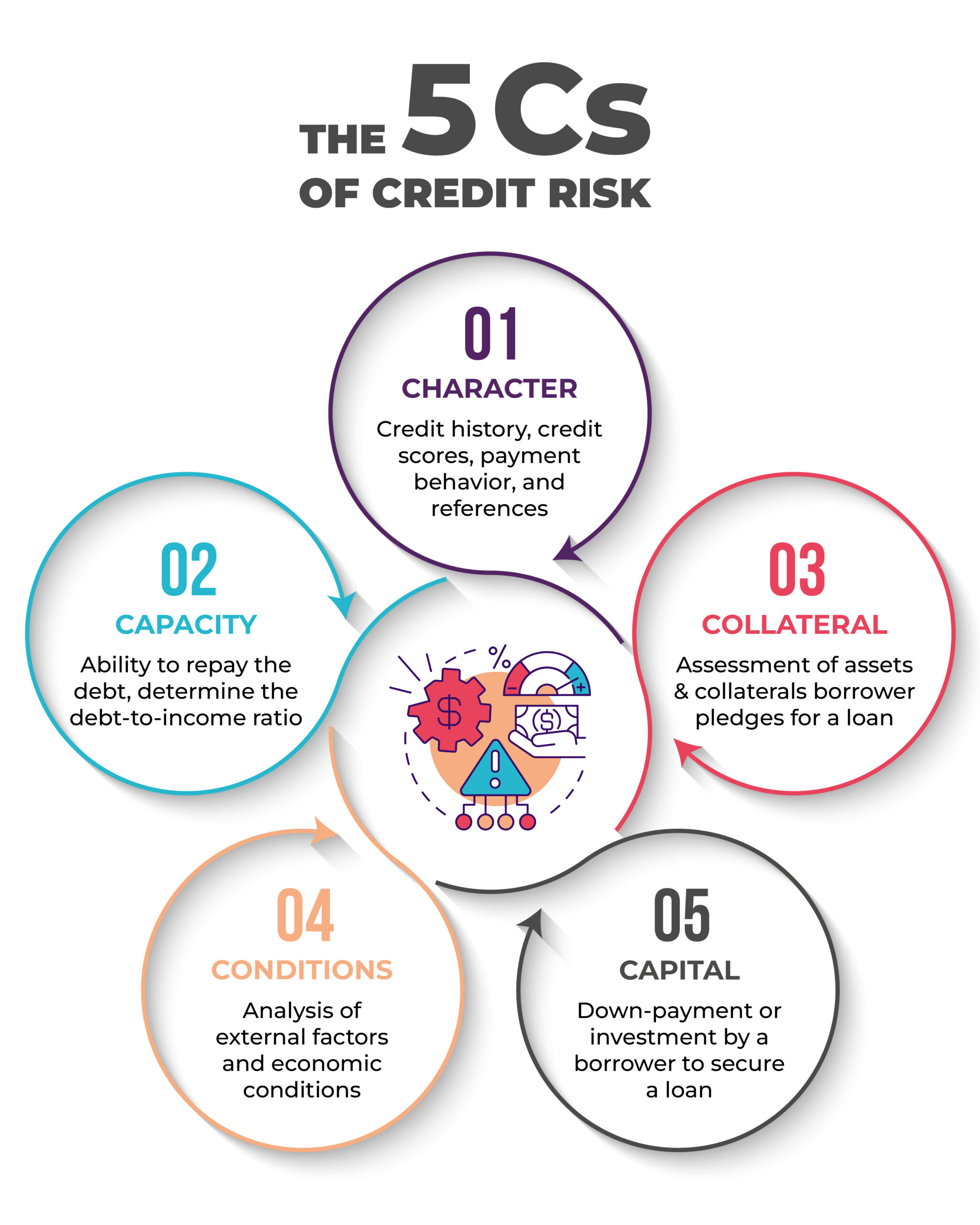

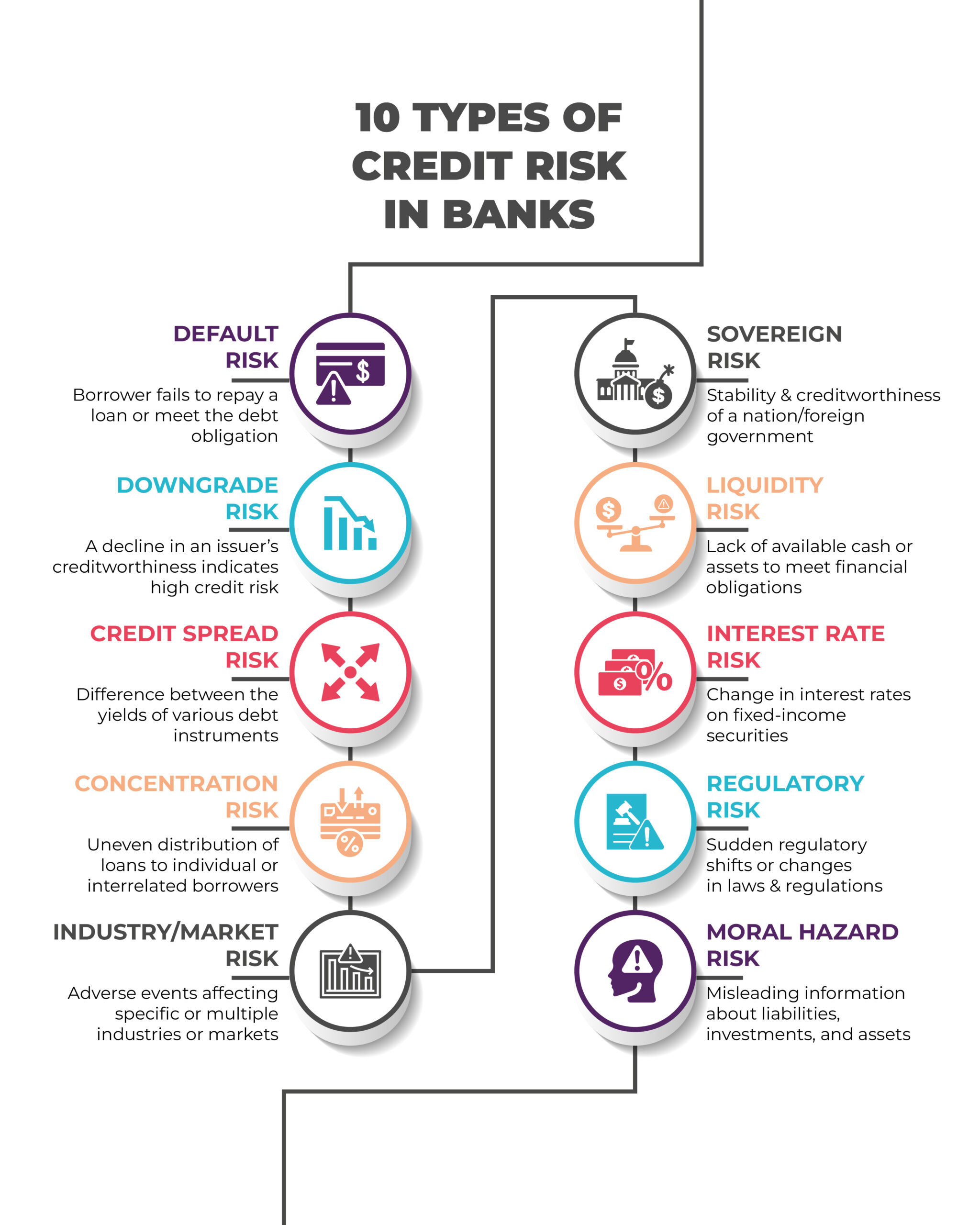

Credit Risk Course - Uec credits assist with traditional soa exams, guiding students to professional designations. The credit risk courses teach core methods for identifying, measuring, monitoring, and controlling risk levels within retail, commercial and agricultural lending, as well as addressing other. This course provides the student with a foundation in the science and mathematics underlying risk assessments at contaminated sites. This course provides insights into the effective management of credit risk models, focusing on the latest basel 3.1 and ifrs 9 requirements. Transfer credit for finance courses is awarded only in certain circumstances. The certificate in risk management covers credit risk, market risk, and time series analysis tools useful for estimating these risks. Each lender has its own standardized approach in performing diligence and gauging the credit risk of the borrower. How to measure the amount of credit risk; These principles provide guidelines for banking supervisory authorities to. Students will also learn different tools and techniques of financial analysis and. Explore current issues related to credit risk management and discuss industry best practices for risk mitigation and regulatory compliance. That means financial institutions need to closely monitor reporting and evaluation standards, as well as expectations around. These principles provide guidelines for banking supervisory authorities to. How to measure the amount of credit risk; The committee has revised its principles for the management of credit risk (credit risk principles). Choose from a wide range of credit risk courses offered by top universities and industry leaders tailored to various skill levels. Each lender has its own standardized approach in performing diligence and gauging the credit risk of the borrower. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Book on respective course website. In the risk management concentration, students focus on the theory of risk management, risk. Convenient for busy professionals, courses are scheduled in the evening at illinois tech’s conviser law center in downtown chicago. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Students will also learn different tools and techniques of financial analysis and. In the risk management concentration, students focus on. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Welcome to redcliffe training, the premier provider of credit risk management courses for seasoned professionals seeking to refine their expertise and advance their careers in the. The prmia credit and counterparty risk management certificate is designed to deliver a. Online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. This course provides insights into the effective management of credit risk models, focusing on the latest basel 3.1 and ifrs 9 requirements. In this module, we'll cover the principles and concepts of credit risk management. Welcome to redcliffe training, the. Choose from a wide range of credit risk courses offered by top universities and industry leaders tailored to various skill levels. The committee has revised its principles for the management of credit risk (credit risk principles). Uec credits assist with traditional soa exams, guiding students to professional designations. Convenient for busy professionals, courses are scheduled in the evening at illinois. This course provides the student with a foundation in the science and mathematics underlying risk assessments at contaminated sites. Choose from a wide range of credit risk courses offered by top universities and industry leaders tailored to various skill levels. The prmia credit and counterparty risk management certificate is designed to deliver a deep, practical understanding of credit risk management. This highly practical course has been specifically designed for. The student will be instructed. The credit risk courses teach core methods for identifying, measuring, monitoring, and controlling risk levels within retail, commercial and agricultural lending, as well as addressing other. In the risk management concentration, students focus on the theory of risk management, risk. Each lender has its own standardized. This course provides insights into the effective management of credit risk models, focusing on the latest basel 3.1 and ifrs 9 requirements. Credit risk assessment regulations vary across geographies. Online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. Explore current issues related to credit risk management and discuss industry. The certificate in risk management covers credit. The course defines the different types of credit risk: Transfer credit for finance courses is awarded only in certain circumstances. Uec credits assist with traditional soa exams, guiding students to professional designations. Online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. Transfer credit for finance courses is awarded only in certain circumstances. The certificate in risk management covers credit. Online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Students. Explore current issues related to credit risk management and discuss industry best practices for risk mitigation and regulatory compliance. The certificate in risk management covers credit. The certificate in risk management covers credit risk, market risk, and time series analysis tools useful for estimating these risks. The credit risk courses teach core methods for identifying, measuring, monitoring, and controlling risk. This course provides the student with a foundation in the science and mathematics underlying risk assessments at contaminated sites. This quantitative program employs tools necessary to. The certificate in risk management covers credit. The course defines the different types of credit risk: The certificate in risk management covers credit risk, market risk, and time series analysis tools useful for estimating these risks. Transfer credit for finance courses is awarded only in certain circumstances. In this module, we'll cover the principles and concepts of credit risk management. The credit risk courses teach core methods for identifying, measuring, monitoring, and controlling risk levels within retail, commercial and agricultural lending, as well as addressing other. Students will also learn different tools and techniques of financial analysis and. The prmia credit and counterparty risk management certificate is designed to deliver a deep, practical understanding of credit risk management and analysis frameworks in financial. We'll review the purpose, benefits and analytical approaches to credit analysis and explore the integrated. The credit analysis process (which identifies whether a client can cope with the credit risk), and. These principles provide guidelines for banking supervisory authorities to. Credit risk assessment regulations vary across geographies. Online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. Up to 10% cash back all you want to know about credit specific risk analysis from a banker’s and analyst perspective.Credit Risk Management Guide for Banks and Financial Institution

Credit Risk Modelling Course IFRS9 Application and Behavior

Best Credit Risk Courses & Certificates [2025] Coursera Learn Online

Credit Risk Modelling Training Course Finance Training Course

Fundamentals of Credit Risk Management

Understanding To Credit Risk and Operational Risk Management

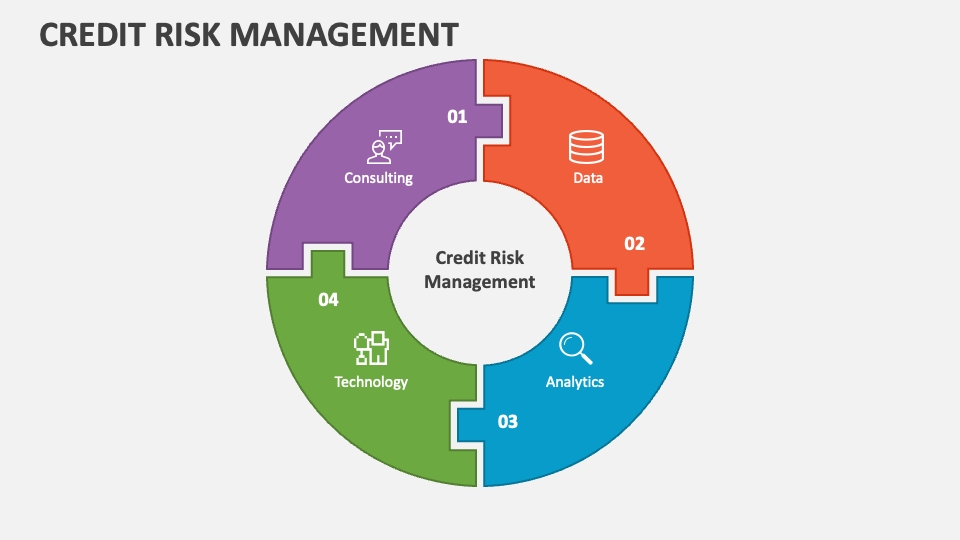

Credit Risk Management PowerPoint and Google Slides Template PPT Slides

TRAINING CREDIT RISK MANAGEMENT (FOR BANK) Informasi Training

Credit Risk Management Principles and Practices, Tools and Techniques

Credit Risk Management Processes, Best Practices & Techniques

This Highly Practical Course Has Been Specifically Designed For.

Choose From A Wide Range Of Credit Risk Courses Offered By Top Universities And Industry Leaders Tailored To Various Skill Levels.

How To Measure The Amount Of Credit Risk;

That Means Financial Institutions Need To Closely Monitor Reporting And Evaluation Standards, As Well As Expectations Around.

Related Post:

![Best Credit Risk Courses & Certificates [2025] Coursera Learn Online](https://d3njjcbhbojbot.cloudfront.net/api/utilities/v1/imageproxy/https://s3.amazonaws.com/coursera-course-photos/7c/b39b1ef55a48238569505b7f2337be/Credit-Risk-Management-LOGO.png?auto=format%2Ccompress%2C enhance&dpr=3&w=265&h=216&fit=crop&q=50)