Debt Capital Markets Course

Debt Capital Markets Course - Understand the need for long term and short term debt; This programme provides an introductory course to debt capital markets, covering both primary and secondary sides of the business. Why choose the a to z of equity (ecm) and debt (dcm) capital markets training course? Transform you career with coursera's online financial markets courses. In this origination, debt capital markets course, learn how dcm and ecm teams work together to introduce new securities into the market. Spend 10 weeks in an immersive learning, training, and development. Products, issuers and investors are all reviewed and the. The icma primary market certificate (pmc) is an essential qualification for those with an interest or involvement in the debt primary markets. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. What do you get on this course? Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. In this origination, debt capital markets course, learn how dcm and ecm teams work together to introduce new securities into the market. Why choose the a to z of equity (ecm) and debt (dcm) capital markets training course? What do you get on this course? The course examines the entire life cycle of bond. Understand the need for long term and short term debt; Products, issuers and investors are all reviewed and the. Discover how ai transforms debt capital markets in our introductory program. This intensive and highly beneficial aztech training course is designed to provide. This programme provides an introductory course to debt capital markets, covering both primary and secondary sides of the business. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. Why choose the a to z of equity (ecm) and debt (dcm) capital markets training course? Learn to apply machine learning, deep learning, and generative ai to enhance data accuracy, liquidity. Discover how ai transforms debt capital markets in. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. Transform you career with coursera's online financial markets courses. In this origination, debt capital markets course, learn how dcm and ecm teams work together to introduce new securities into the market. Why choose the a to z of equity. Transform you career with coursera's online financial markets courses. The course will describe the major players in debt capital markets, key institutions, broad empirical regularities, and analytical tools that are used for pricing and risk management. Icma’s diploma in securities & derivatives is the definitive programme for the fixed income and related derivatives markets, giving a thorough grounding in the. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. The icma primary market certificate (pmc) is an essential qualification for those with an interest or involvement in the debt primary markets. What do you get on this course? The course examines the entire life cycle of bond. Icma’s. Discover how ai transforms debt capital markets in our introductory program. In this origination, debt capital markets course, learn how dcm and ecm teams work together to introduce new securities into the market. The a to z of equity (ecm) and debt (dcm) capital markets training course is designed to equip managers, supervisors, and business professionals with a comprehensive understanding. This programme provides an introductory course to debt capital markets, covering both primary and secondary sides of the business. The icma primary market certificate (pmc) is an essential qualification for those with an interest or involvement in the debt primary markets. The a to z of equity (ecm) and debt (dcm) capital markets training course is designed to equip managers,. The course examines the entire life cycle of bond. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. The icma primary market certificate (pmc) is an essential qualification for those with an interest or involvement in the debt primary markets. Icma’s diploma in securities & derivatives is the. Why choose the a to z of equity (ecm) and debt (dcm) capital markets training course? This programme provides an introductory course to debt capital markets, covering both primary and secondary sides of the business. Understand the need for long term and short term debt; What do you get on this course? The course will describe the major players in. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. Learn to apply machine learning, deep learning, and generative ai to enhance data accuracy, liquidity. Products, issuers and investors are all reviewed and the. Understand the differences between overdrafts, revolving credit facilities and commercial. Discover how ai transforms debt. Spend 10 weeks in an immersive learning, training, and development. Icma’s diploma in securities & derivatives is the definitive programme for the fixed income and related derivatives markets, giving a thorough grounding in the characteristics and benefits of. Transform you career with coursera's online financial markets courses. This intensive and highly beneficial aztech training course is designed to provide. The. Understand the differences between overdrafts, revolving credit facilities and commercial. In this origination, debt capital markets course, learn how dcm and ecm teams work together to introduce new securities into the market. The course will describe the major players in debt capital markets, key institutions, broad empirical regularities, and analytical tools that are used for pricing and risk management. Why choose the a to z of equity (ecm) and debt (dcm) capital markets training course? What do you get on this course? Discover how ai transforms debt capital markets in our introductory program. Icma’s diploma in securities & derivatives is the definitive programme for the fixed income and related derivatives markets, giving a thorough grounding in the characteristics and benefits of. Spend 10 weeks in an immersive learning, training, and development. Understand the need for long term and short term debt; Learn to apply machine learning, deep learning, and generative ai to enhance data accuracy, liquidity. The course examines the entire life cycle of bond. Find innovative options for any capital requirement with our unique combination of robust lender relationships, leading deal volume and proprietary technology. Products, issuers and investors are all reviewed and the. This programme provides an introductory course to debt capital markets, covering both primary and secondary sides of the business.Capital Markets & Securities Analyst Certification Course YouTube

Insider Tips from Industry Experts Choosing the Right Debt Capital

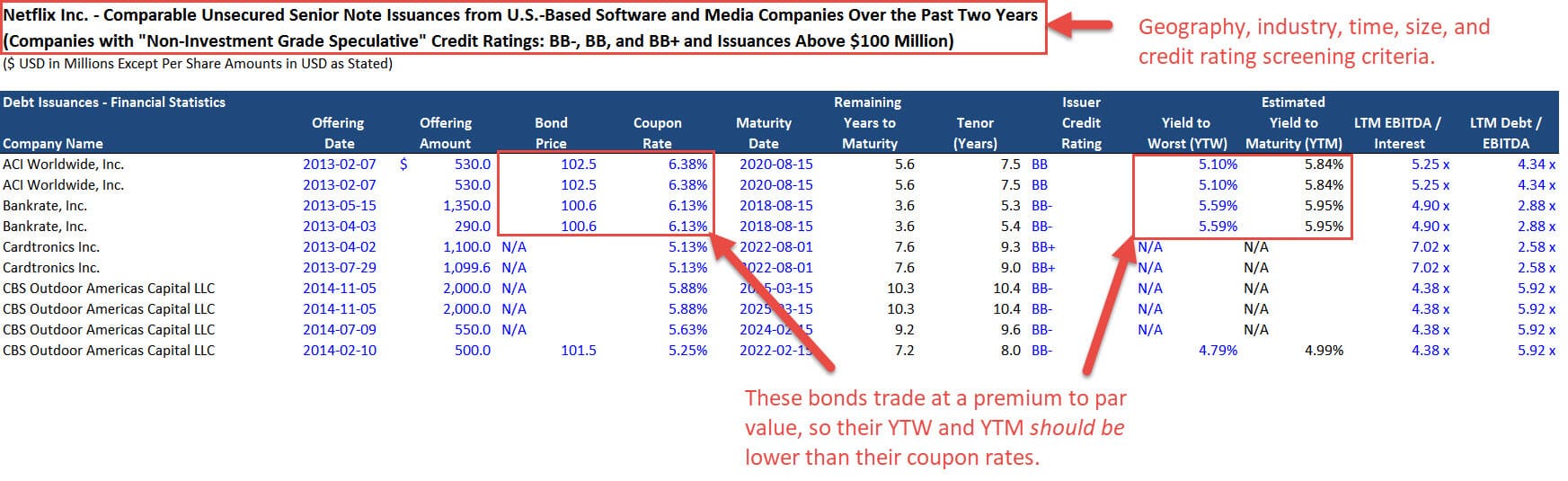

Origination Fundamentals Debt Capital Markets CFI

Origination Fundamentals Debt Capital Markets CFI

Debt Capital Markets (DCM) Explained Definitive Guide

Debt Capital Markets (DCM) Explained Definitive Guide

Debt Capital Markets (DCM) Explained YouTube

An Introduction to Debt Capital Markets

Debt Capital Markets Part I Courses & Pathways Euromoney Learning

Debt Capital Market mechanics of new bond issues Capital Markets

Transform You Career With Coursera's Online Financial Markets Courses.

The A To Z Of Equity (Ecm) And Debt (Dcm) Capital Markets Training Course Is Designed To Equip Managers, Supervisors, And Business Professionals With A Comprehensive Understanding Of.

This Intensive And Highly Beneficial Aztech Training Course Is Designed To Provide.

The Icma Primary Market Certificate (Pmc) Is An Essential Qualification For Those With An Interest Or Involvement In The Debt Primary Markets.

Related Post: