Ebitda Course

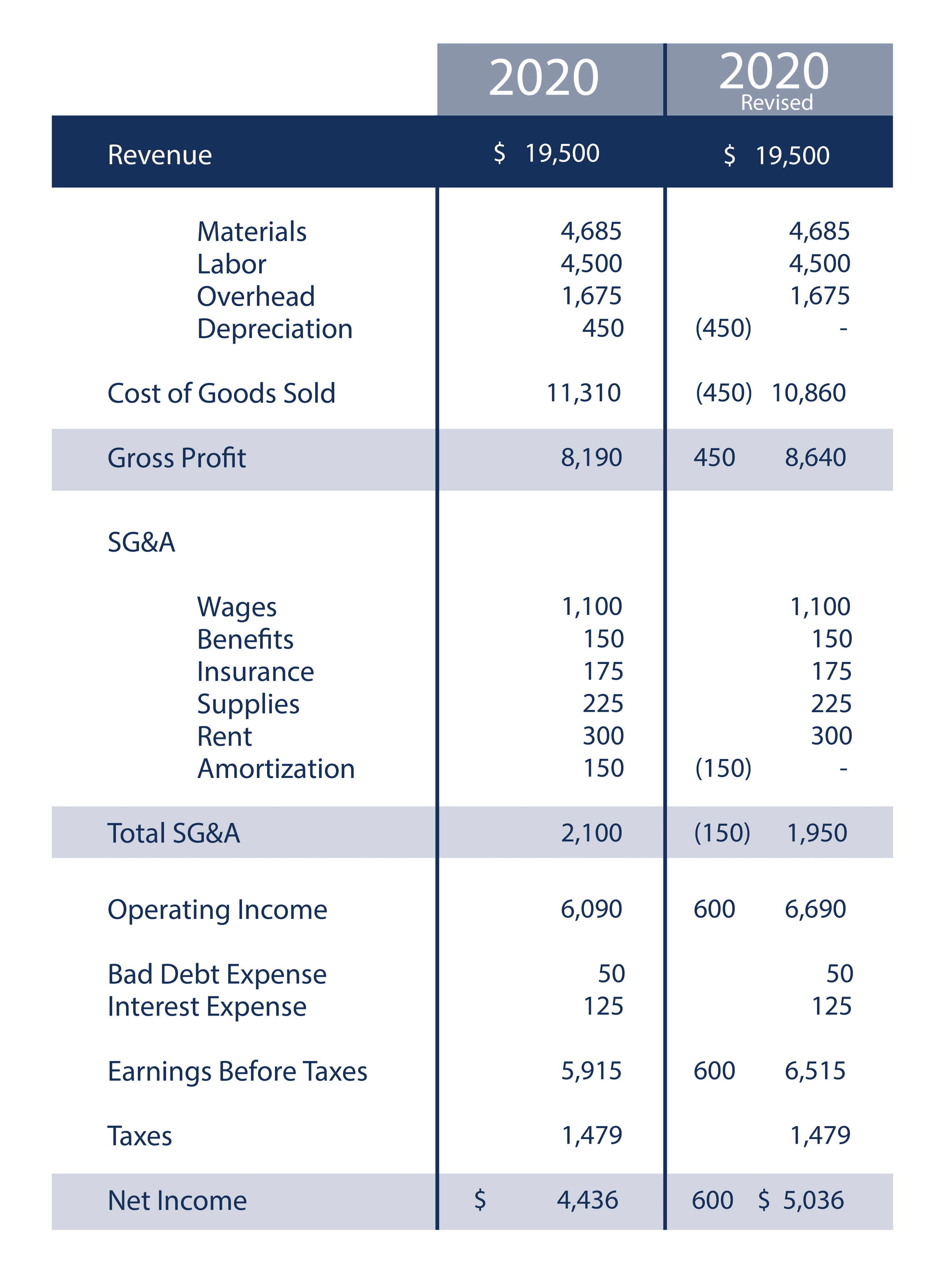

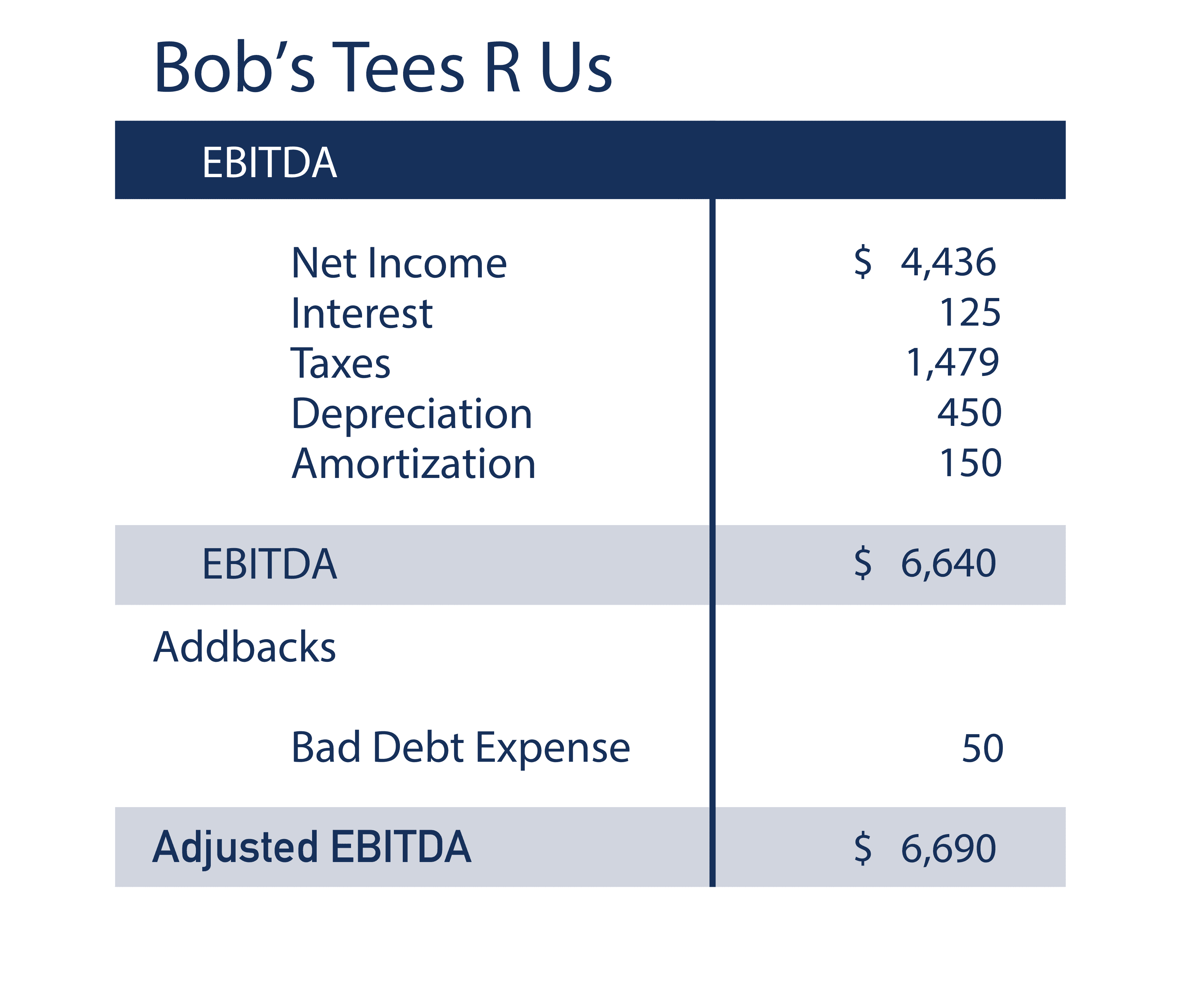

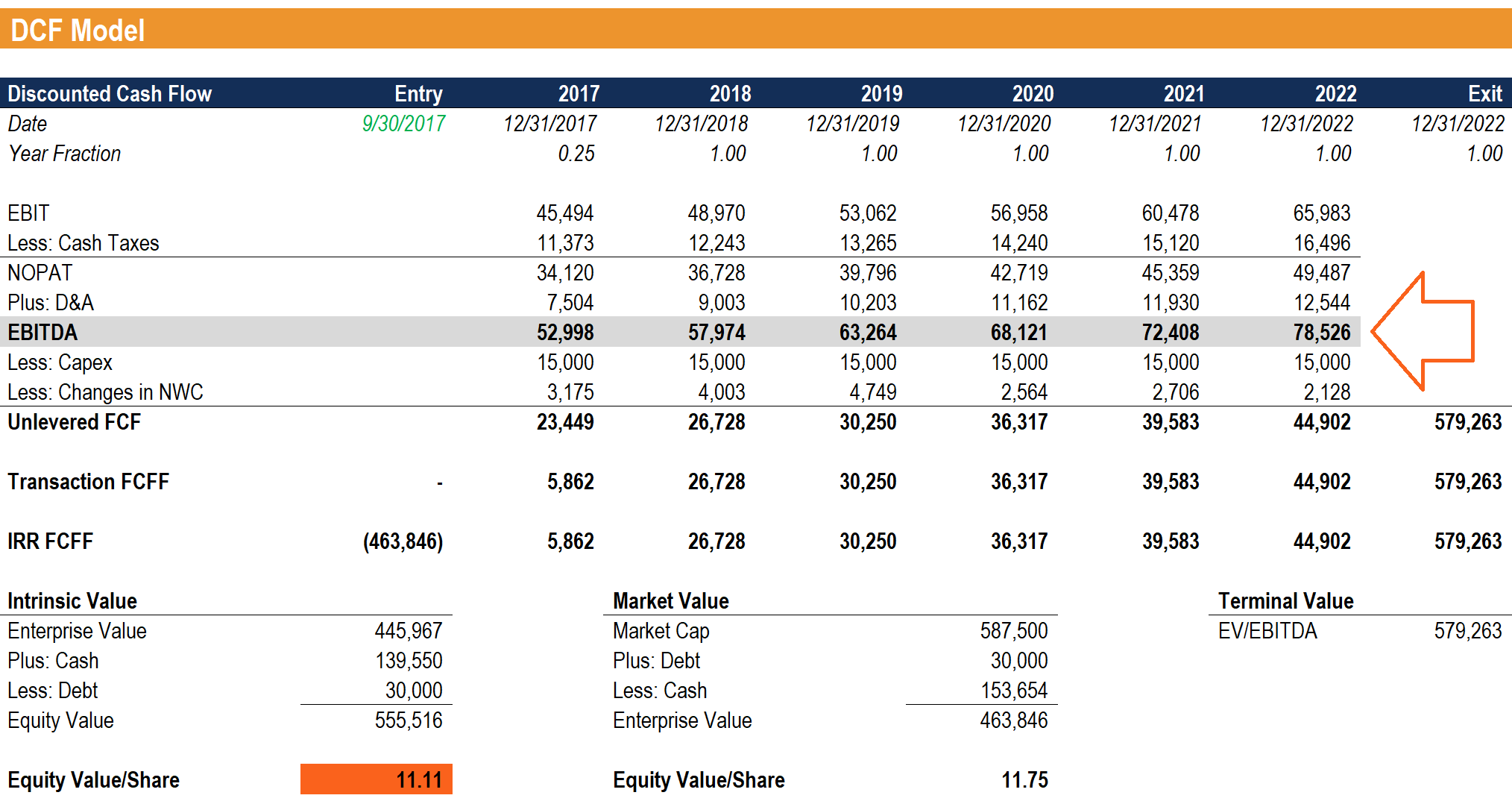

Ebitda Course - Ebitda boils down a company’s financial information to its bare bones. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Specifically, it provides a clearer understanding of operating profitability and general cash flow. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Learn how to analyze income statements and ebitda performance with this comprehensive course. Watch this free acca apm video explaining ebitda. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. By understanding the factors that influence these multiples, such as industry,. Understand variances, calculate gross profit, and visualize perfor. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Ebitda boils down a company’s financial information to its bare bones. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Understand variances, calculate gross profit, and visualize perfor. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Watch this free acca apm video explaining ebitda. Learn how to analyze income statements and ebitda performance with this comprehensive course. Watch this free acca apm video explaining ebitda. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Ebitda boils down a company’s financial information to its bare bones. By understanding. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Ebitda boils down a company’s financial information to its bare bones. Take our financial ratios exam. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Business. Ebitda is the acronym for earnings before interest, taxes, depreciation and amortization. Ebitda boils down a company’s financial information to its bare bones. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. Business owners use ebitda to monitor their company's cash flow and to. Ebitda boils down a company’s financial information to its bare bones. Learn how to analyze income statements and ebitda performance with this comprehensive course. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. By understanding the factors that influence these multiples, such as industry,. Learn how to analyze income statements and ebitda performance with this. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Take our financial ratios exam. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure. Specifically, it provides a clearer understanding of operating profitability and general cash flow. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. Ebitda boils down a company’s financial information to its bare bones. Learn how ebitda impacts. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. By understanding the factors that influence these multiples, such as industry,. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. Earnings before interest, taxes, depreciation,. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Understand variances, calculate gross profit, and visualize perfor. By understanding the factors that influence these multiples, such as industry,. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. In contrast, the formula to. Watch this free acca apm video explaining ebitda. You’ll learn how m&a works, how to analyze it conceptually, and how to build m&a models to measure financial viability. In contrast, the formula to. Understand variances, calculate gross profit, and visualize perfor. Take our financial ratios exam. With bankershub’s why ebitda doesn't spell cash flow course, banking professionals and investors can explore why ebitda is an unreliable indicator of cash flow. Earnings before interest, taxes, depreciation, and amortization—also called ebitda—is a record of the amount of money a company generated. Business owners use ebitda to monitor their company's cash flow and to analyze the profitability of core operations before taking into account capital expenditures, tax rates,. Learn how ebitda impacts investment decisions, valuation techniques, and strategic planning. Gain practical insights into adjusting ebitda for accurate financial modeling, and understand. In this tutorial, we're going to review ebit and ebitda using real examples from facebook and dave & busters. Ebitda multiples are a critical tool for evaluating the value of a business in the private equity and m&a industry. Ebitda boils down a company’s financial information to its bare bones.Mastering EBITDA Your GoTo Cheat Sheet for Financial Analysis! 📊💪

Lecture 9 Calculating Operating Profit & EBITDA Course Tableau for

Full EBITDA Guide What is It & How Investors Use It (Formula)

[Solved] using EBITDA Calculation, Balance Sheets, and

Full EBITDA Guide What is It & How Investors Use It (Formula)

Lecture 7 Calculating Gross Profit & EBITDA (Course Financial

EV/EBITDA Multiple EUVietnam Business Network (EVBN)

[Solved] using EBITDA Calculation, Balance Sheets, and

What is EBITDA Formula, Definition and Explanation

A Guide to Ebitda EBITDA 1 Swipe 1 CFO for Startups Founder & CEO

Learn How To Analyze Income Statements And Ebitda Performance With This Comprehensive Course.

By Understanding The Factors That Influence These Multiples, Such As Industry,.

Ebitda Is The Acronym For Earnings Before Interest, Taxes, Depreciation And Amortization.

Specifically, It Provides A Clearer Understanding Of Operating Profitability And General Cash Flow.

Related Post: