Esg Risk Management Course

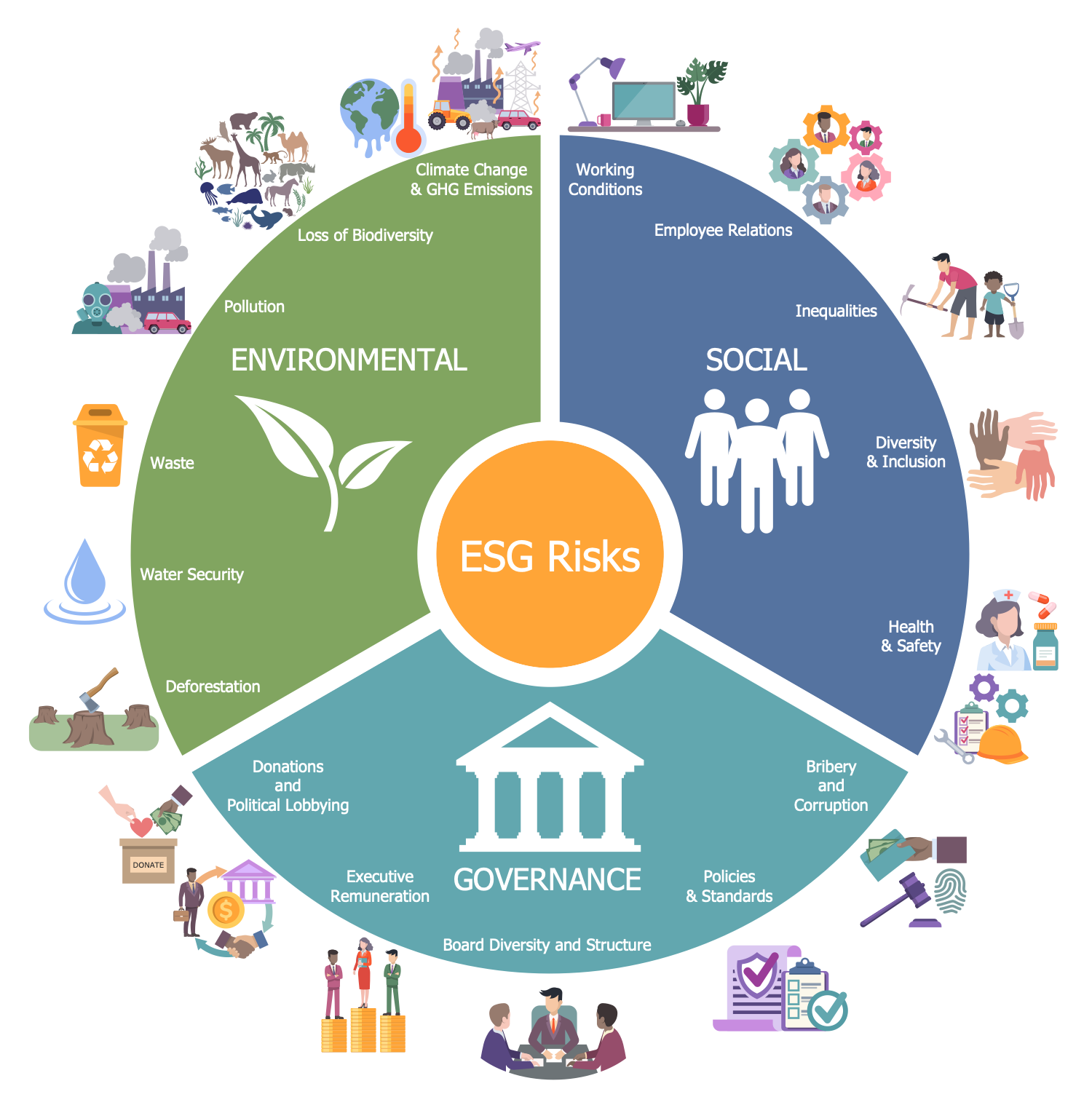

Esg Risk Management Course - The guidance, issued in 2023 by the occ, fdic, and board of governors of the federal reserve, required financial institutions managing over $100 billion in total assets to. Invest in esg reporting tools. When esg indicators are monitored consistently, risks become more visible and easier to. Master quantitative methods, model esg factors, and drive sustainability. Ideal for professionals, this program. It examines each component in detail and provides insight into how they. As the requirement to address. As the requirement to address esg risks grows, this. It is also suitable for anyone working in sales & distribution,. Transform you career with coursera's online esg courses. Politicization may complicate the narrative, but regulatory imperatives will drive. The course provides managers across all sectors with a comprehensive introduction to esg risk management practice. As the requirement to address esg risks grows, this. Invest in esg reporting tools. Learn to assess, design, and implement esg best practices and tactics for any corporate scenario. The baumhart certificate in esg is built with and for practitioners to accelerate esg reporting and impact. Ideal for professionals, this program. This course provides an overview of the effect of climate change on organizations and how to manage that risk. The guidance, issued in 2023 by the occ, fdic, and board of governors of the federal reserve, required financial institutions managing over $100 billion in total assets to. As the requirement to address. The 'best practice in esg and risk management' certificate offers comprehensive training on integrating esg principles with risk management strategies. This course provides an overview of an esg framework and how it supports a company’s overall risk management. It is also suitable for anyone working in sales & distribution,. You will learn how to integrate esg risks into existing risk. As the requirement to address. Reporting esg data helps embed sustainability into your company’s risk management process. Designed for practitioners working in investment roles who want to learn how to analyze and integrate material esg factors. In 2025, the esg landscape will be shaped by external and internal forces to businesses. Politicization may complicate the narrative, but regulatory imperatives will. Politicization may complicate the narrative, but regulatory imperatives will drive. Explore the principles of sustainable investing and responsible business practices. Our online course, esg risk management, provides managers across all sectors with a comprehensive introduction to esg risk management practice. It is also suitable for anyone working in sales & distribution,. As the requirement to address. Lead your organization in the age of esg with cfi's esg risk management course. Reporting esg data helps embed sustainability into your company’s risk management process. In 2025, the esg landscape will be shaped by external and internal forces to businesses. It examines each component in detail and provides insight into how they. Invest in esg reporting tools. Ideal for professionals, this program. Learn more about the application of esg analysis across a range of asset classes and the different approaches for esg integration into the portfolio management process topic weight:. It is also suitable for anyone working in sales & distribution,. Lead your organization in the age of esg with cfi's esg risk management course. This course. Our online course, esg risk management, provides managers across all sectors with a comprehensive introduction to esg risk management practice. In 2025, the esg landscape will be shaped by external and internal forces to businesses. Explore the principles of sustainable investing and responsible business practices. The certificate will equip leaders with the skills to be effective today and the knowledge.. The guidance, issued in 2023 by the occ, fdic, and board of governors of the federal reserve, required financial institutions managing over $100 billion in total assets to. When esg indicators are monitored consistently, risks become more visible and easier to. As the requirement to address esg risks grows, this. Led by an expert practitioner, the workshop will. In 2025,. Ideal for professionals, this program. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Designed for practitioners working in investment roles who want to learn how to analyze and integrate material esg factors. The guidelines on the management of environmental, social and governance (esg) risks set out requirements. This masterclass combines the content of our four most popular and practical courses—fundamentals of risk management (form), embedding risk management (erm),. Led by an expert practitioner, the workshop will. Invest in esg reporting tools. Politicization may complicate the narrative, but regulatory imperatives will drive. It is also suitable for anyone working in sales & distribution,. It examines each component in detail and provides insight into how they. Learn to assess, design, and implement esg best practices and tactics for any corporate scenario. Be ready to accelerate esg reporting and impact through the loyola university chicago baumhart environmental, social, and governance certificate. When esg indicators are monitored consistently, risks become more visible and easier to. Learn. Invest in esg reporting tools. Led by an expert practitioner, the workshop will. You will learn how to integrate esg risks into existing risk strategy and risk management frameworks, and will examine the new methodologies which help benchmark. Learn about esg risks and opportunities in this online course. Learn to assess, design, and implement esg best practices and tactics for any corporate scenario. The course provides managers across all sectors with a comprehensive introduction to esg risk management practice. The guidance, issued in 2023 by the occ, fdic, and board of governors of the federal reserve, required financial institutions managing over $100 billion in total assets to. Designed for practitioners working in investment roles who want to learn how to analyze and integrate material esg factors. This course provides the principles and techniques that underpin various models of esg (environmental, social, and corporate governance) investing and impact investing from. It is also suitable for anyone working in sales & distribution,. This course provides an overview of the effect of climate change on organizations and how to manage that risk. Transform you career with coursera's online esg courses. Our online course, esg risk management, provides managers across all sectors with a comprehensive introduction to esg risk management practice. When esg indicators are monitored consistently, risks become more visible and easier to. Politicization may complicate the narrative, but regulatory imperatives will drive. This course provides an overview of an esg framework and how it supports a company’s overall risk management.Academy Euronext Group on LinkedIn Integrating ESG risks into

Embedding ESGrisk into Your Risk Management Framework (COSO) Sleeman

KPMG (2021) ESG risksinbanks ESG risks in banks Effective

ESG risk management best practices Scrut Automation

Esg Framework Template

ESG Risk Management Corporate Finance Institute

ESG Risk Management Corporate Finance Institute

ESG Risk Management Corporate Finance Institute

The ESG Risk Landscape, Part 3 Evaluating ESG Risk

ESG Risk Management Framework Building Sustainability

Be Ready To Accelerate Esg Reporting And Impact Through The Loyola University Chicago Baumhart Environmental, Social, And Governance Certificate.

Learn More About The Application Of Esg Analysis Across A Range Of Asset Classes And The Different Approaches For Esg Integration Into The Portfolio Management Process Topic Weight:.

It Aims To Enhance Corporate.

The 'Best Practice In Esg And Risk Management' Certificate Offers Comprehensive Training On Integrating Esg Principles With Risk Management Strategies.

Related Post: