Fixed Income Courses

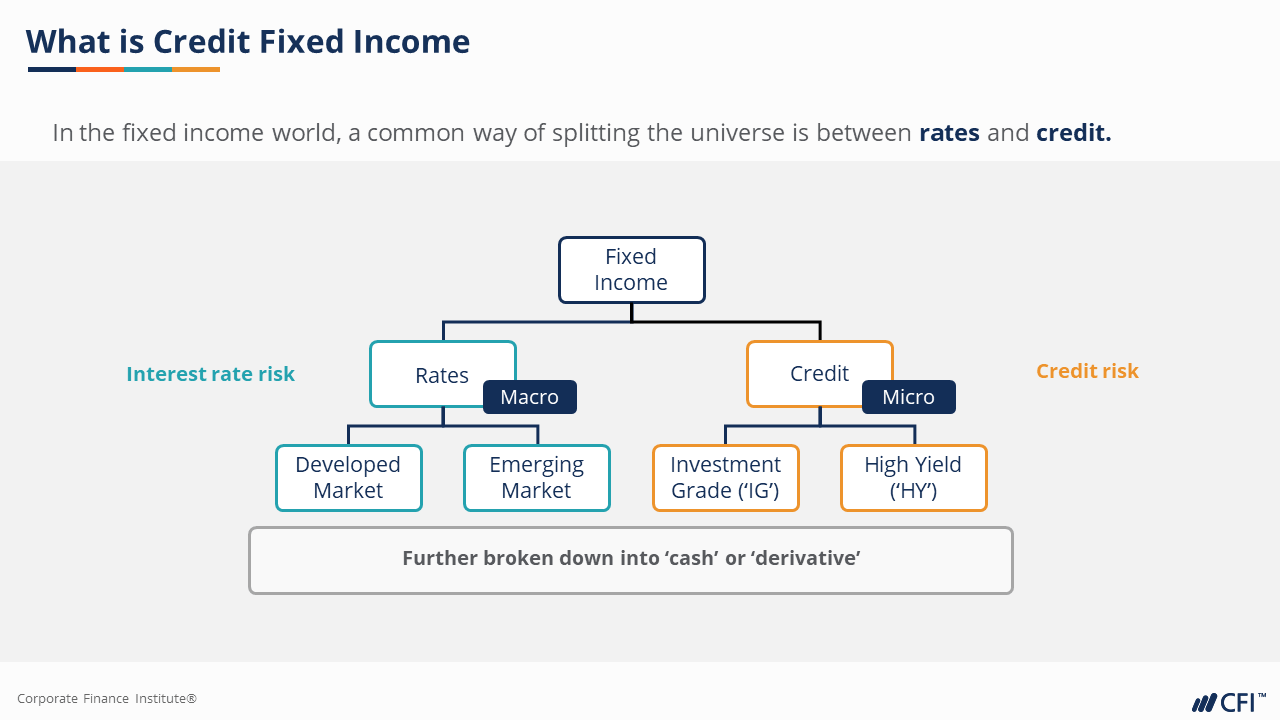

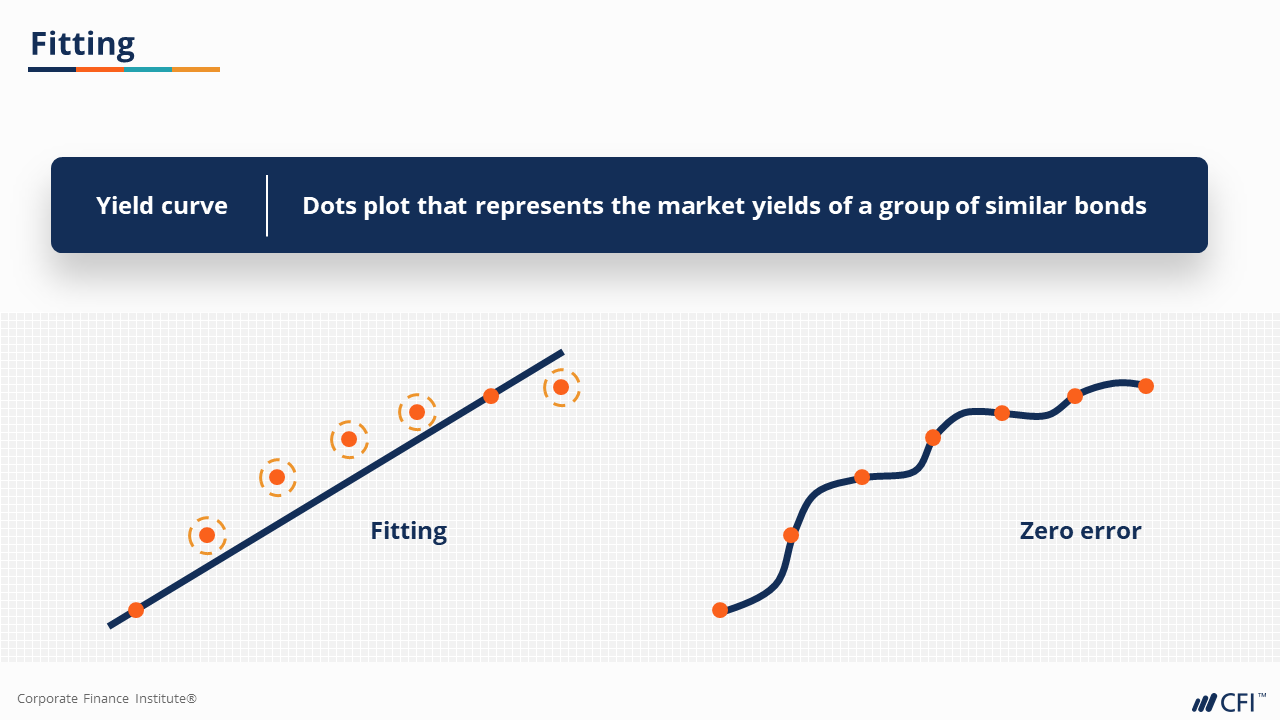

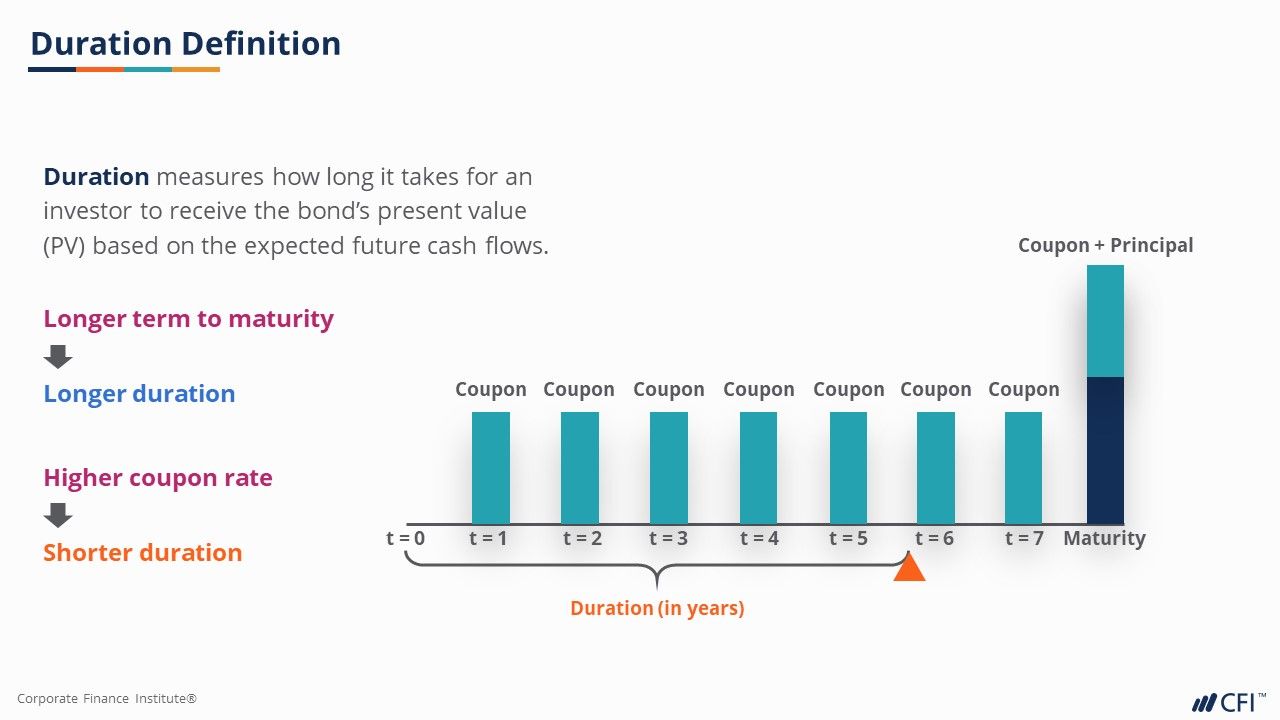

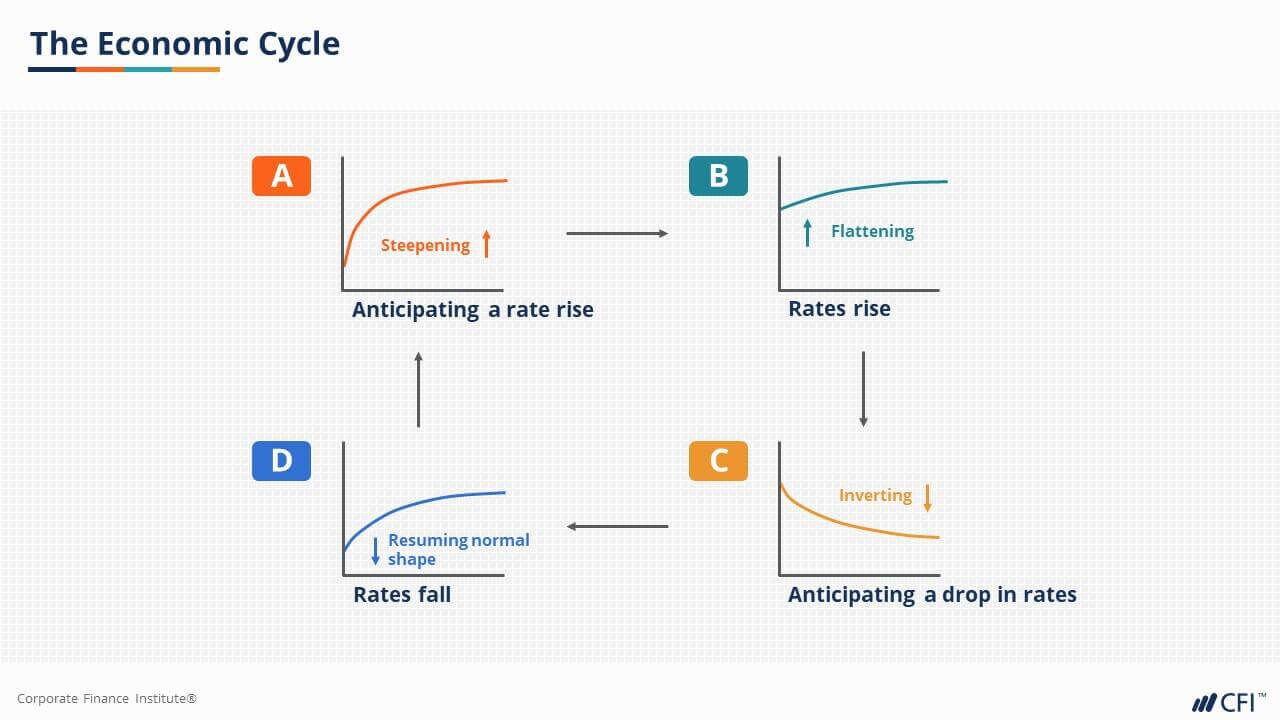

Fixed Income Courses - Valuation of fixed income securities, term structure estimation and arbitrage trading with practical application using real. Valuation of fixed income securities, term structure estimation, financial engineering of fixed income securities, securities. Suppose you have a bond. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon your existing knowledge of the fixed income markets to give you the. Explore comprehensive training from industry experts. Ideal for beginners and professionals seeking to enhance their financial. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. Monetary policy impacts both the. Analyzes the impact of financial. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. Ideal for beginners and professionals seeking to enhance their financial. 3/10/2022, 10pm cst, electronically, just submit your r file. Enrolling in a fitch learning course automatically includes complimentary membership to the. We will introduce key bond features such as par value,. Assignment #1 18 points total 1. Risk from fixed income transactions is studied along with an overview of yield curve transactions. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. Learn with university partners and peers from around the world. Get your team access to over 27,000 top udemy courses, anytime, anywhere. At gfmi, we offer a full suite of fixed income courses including an introduction to fixed income, repurchase agreements, and yield curve analysis. Fin 515 at the university of illinois at chicago (uic) in chicago, illinois. Ideal for beginners and professionals seeking to enhance their financial. Suppose you have a bond. Analyzes the impact of financial. Risk from fixed income transactions is studied along with an overview of yield curve transactions. Ideal for beginners and professionals seeking to enhance their financial. 3/10/2022, 10pm cst, electronically, just submit your r file. Get your team access to over 27,000 top udemy courses, anytime, anywhere. Learn with university partners and peers from around the world. Our repurchase agreement course is. Fin 415 at the university of illinois at chicago (uic) in chicago, illinois. Valuation of fixed income securities, term structure estimation and arbitrage trading with practical application using real. Suppose you have a bond. We will introduce key bond features such as par value,. Analyzes the impact of financial. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon your existing knowledge of the fixed income markets to give you the. Fixed income securities, including bonds, treasuries, and notes, serve as the backbone for diversified investment strategies. Get your team access to over 27,000 top udemy courses, anytime, anywhere. Our first. Assignment #1 18 points total 1. Learn with university partners and peers from around the world. Our first lesson in this course focused on how central banks use monetary policy to control the price of money largely through the control of interest rates. In this fixed income fundamentals course, we will explore the basic products and players in fixed income. Explore comprehensive training from industry experts. Get your team access to over 27,000 top udemy courses, anytime, anywhere. Fin 415 at the university of illinois at chicago (uic) in chicago, illinois. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon your existing knowledge of the fixed income markets to give you. Our repurchase agreement course is. Enrolling in a fitch learning course automatically includes complimentary membership to the. Explore comprehensive training from industry experts. Get your team access to over 27,000 top udemy courses, anytime, anywhere. Learn with university partners and peers from around the world. Enrolling in a fitch learning course automatically includes complimentary membership to the. Our first lesson in this course focused on how central banks use monetary policy to control the price of money largely through the control of interest rates. Our repurchase agreement course is. 3/10/2022, 10pm cst, electronically, just submit your r file. Analyzes the impact of financial. Fixed income securities, including bonds, treasuries, and notes, serve as the backbone for diversified investment strategies. We will introduce key bond features such as par value, coupon, yield curves,. Analyzes the impact of financial. Fin 515 at the university of illinois at chicago (uic) in chicago, illinois. Each type comes with unique characteristics such as interest. Suppose you have a bond. Fin 415 at the university of illinois at chicago (uic) in chicago, illinois. 3/10/2022, 10pm cst, electronically, just submit your r file. We will introduce key bond features such as par value,. Risk from fixed income transactions is studied along with an overview of yield curve transactions. Choose from the industry's most comprehensive selection of fixed income courses for finance professionals, or enroll and jump right into a certification program. Valuation of fixed income securities, term structure estimation, financial engineering of fixed income securities, securities. Enrolling in a fitch learning course automatically includes complimentary membership to the. Monetary policy impacts both the. Our first lesson in this course focused on how central banks use monetary policy to control the price of money largely through the control of interest rates. Valuation of fixed income securities, term structure estimation and arbitrage trading with practical application using real. Fin 415 at the university of illinois at chicago (uic) in chicago, illinois. Fin 515 at the university of illinois at chicago (uic) in chicago, illinois. Assignment #1 18 points total 1. Our repurchase agreement course is. We will introduce key bond features such as par value,. Suppose you have a bond. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. At gfmi, we offer a full suite of fixed income courses including an introduction to fixed income, repurchase agreements, and yield curve analysis. Explore comprehensive training from industry experts. Analyzes the impact of financial.Credit Fixed I Finance Course I CFI

Learn Fixed Corporate Finance Institute

Advanced Fixed I Finance Course I CFI

Fixed Course (9 Courses Bundle, Online Certification)

Introduction to the Fixed and Rates Markets Asset Class Ltd

Fundamentals of Fixed Course I Finance Course I CFI

Fundamentals of Fixed Course I Finance Course I CFI

EDUCBA Finance All Courses & Certification Online

Fundamentals of Fixed Course I Finance Course I CFI

Advanced Fixed I Finance Course I CFI

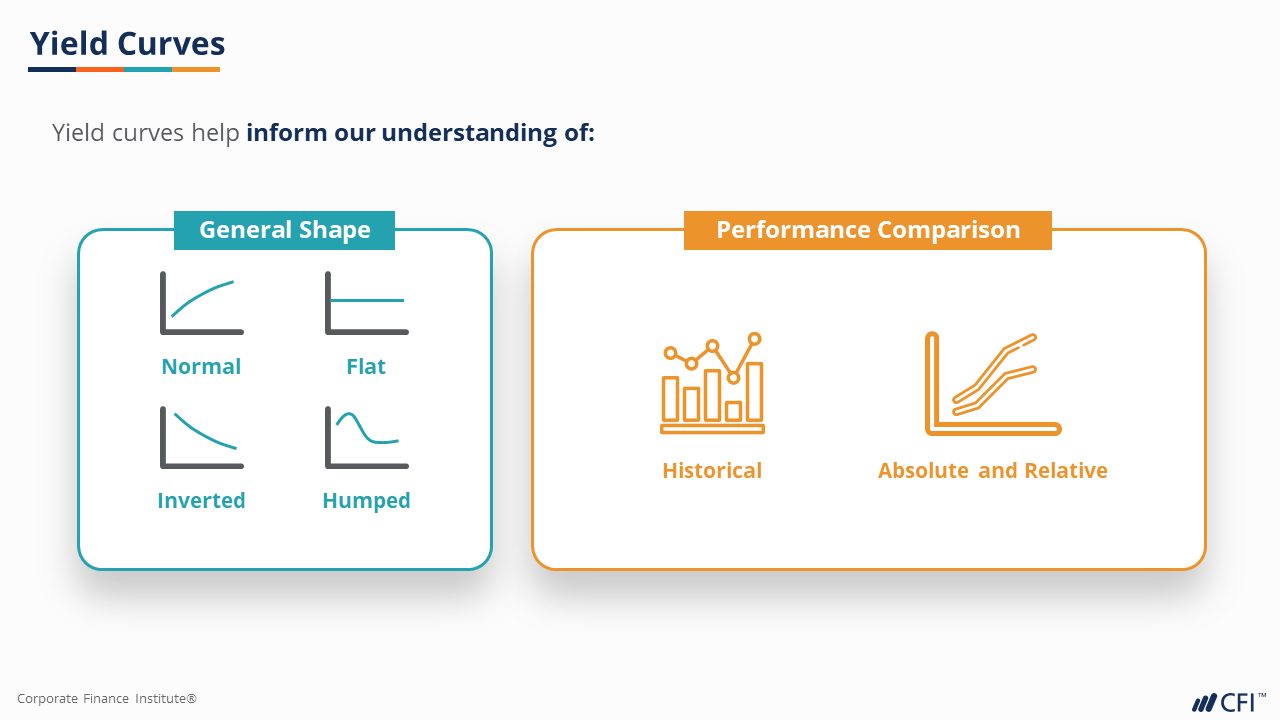

Risk From Fixed Income Transactions Is Studied Along With An Overview Of Yield Curve Transactions.

We Will Introduce Key Bond Features Such As Par Value, Coupon, Yield Curves,.

Learn With University Partners And Peers From Around The World.

Ideal For Beginners And Professionals Seeking To Enhance Their Financial.

Related Post: