Golf Course Sales Tax In Michigan

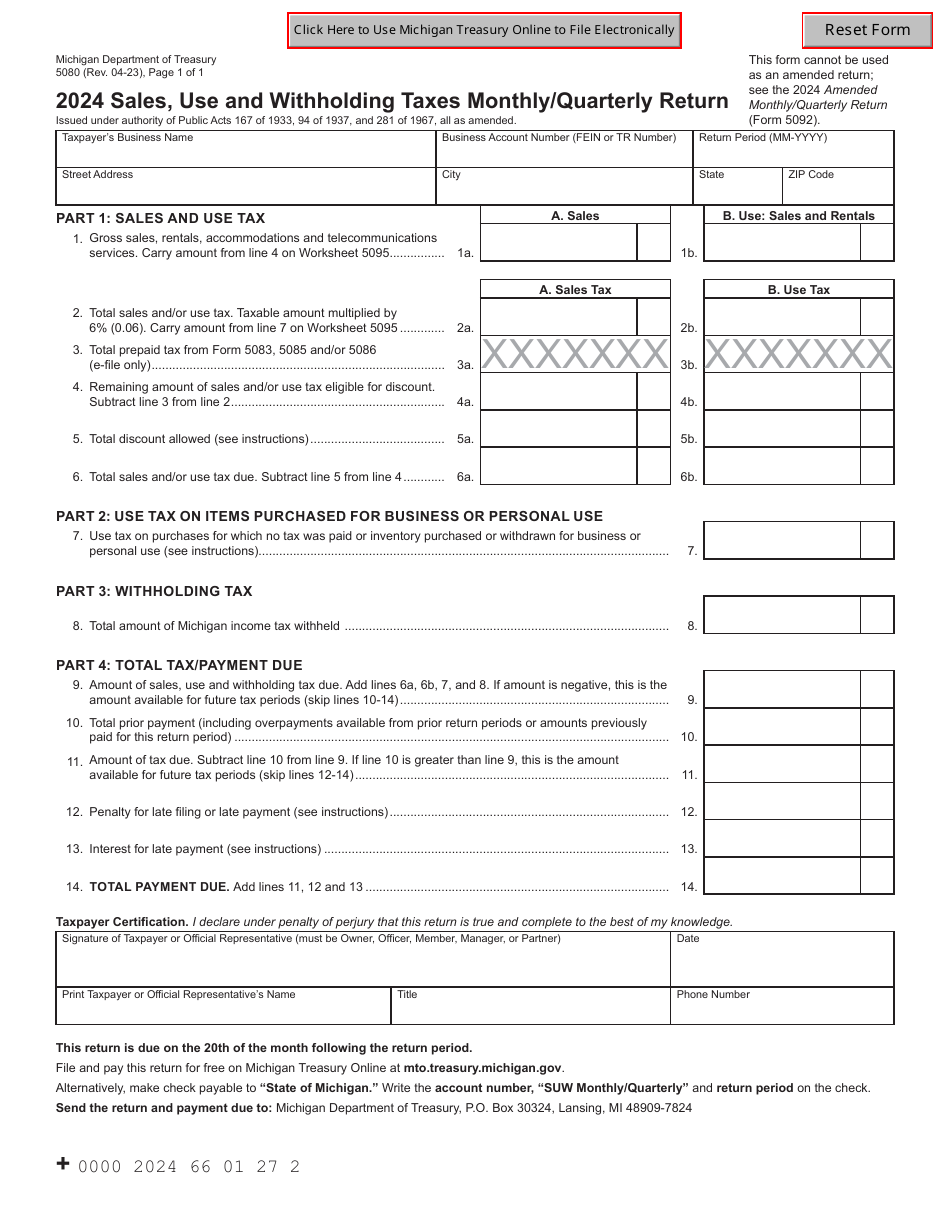

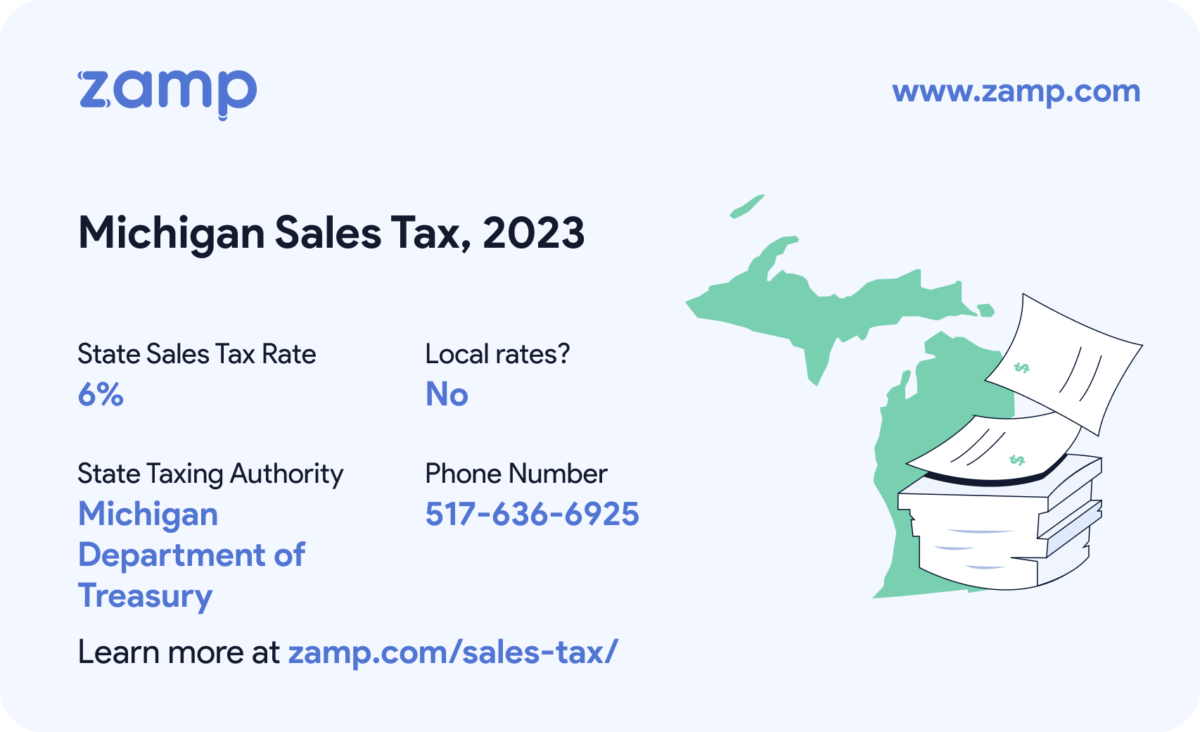

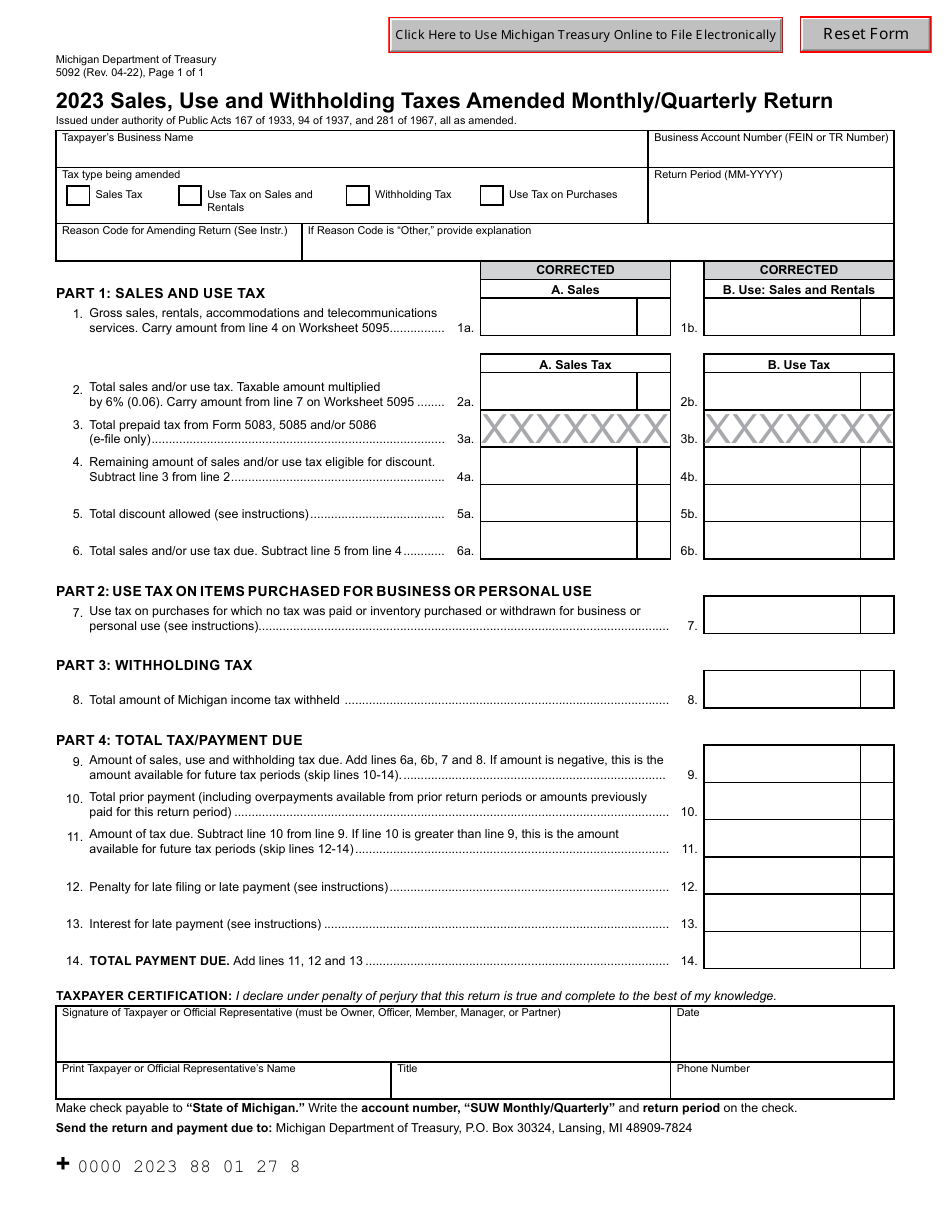

Golf Course Sales Tax In Michigan - The sales and use tax for michigan is 6 percent for tangible personal property. The state sales tax rate in michigan stands at 6% as of 2023. There are a total of 177 local tax jurisdictions across the state, collecting an. This flat rate applies regardless of the county or city in which the transaction takes. Find sales and use tax information for michigan: Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller, certain types of equipment which is used in the agricultural business, or some. Michael rende, mai, prepared an appraisal for tax years 2005, 2006, 2007, and 2008. Residential utilities are taxed at 4 percent. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. The mi sales tax rate is 6%. Michigan imposes a state sales tax and does not allow cities or localities to impose local sales taxes so there are no local sales tax rates in mi. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller, certain types of equipment which is used in the agricultural business, or some. This flat rate applies regardless of the county or city in which the transaction takes. The sales and use tax for michigan is 6 percent for tangible personal property. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. Sales tax exemptions in michigan provide essential. Explore the rules and eligibility criteria for michigan sales tax exemptions, covering key sectors and compliance essentials. What is the sales tax rate in michigan? Sales tax compliance in michigan is crucial for businesses to avoid financial penalties and maintain good standing with state taxation authorities. Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. Find sales and use tax information for michigan: What is the sales tax rate in michigan? The mi sales tax rate is 6%. The state sales tax rate in michigan stands at 6% as of 2023. The sales and use tax for michigan is 6 percent for tangible personal property. Our free online guide for business owners covers michigan sales tax registration, collecting, filing, due dates, nexus obligations, and more. The golf course or a conglomerate would purchase the subject property. Find sales and use tax information for michigan: Michigan’s sales and use tax laws incorporate numerous exemptions and exclusions, offering relief to certain transactions and entities under specific conditions.. What is the michigan sales tax for 2022? Sales tax compliance in michigan is crucial for businesses to avoid financial penalties and maintain good standing with state taxation authorities. Per section 205.52 of the general sales tax act, all persons engaged in a retail business or selling tangible personal property must pay the michigan sales tax. The sales and use. Michigan’s sales tax rate is 6%, a uniform rate that applies to all taxable sales of tangible personal property as outlined by the general sales tax act, act 167 of 1933. The state sales tax rate in michigan stands at 6% as of 2023. Michigan has state sales tax of 6%, and allows local governments to collect a local option. Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. Michigan imposes a state sales tax and does not allow cities or localities to impose local sales taxes so there are no local sales tax. Find sales and use tax information for michigan: The golf course or a conglomerate would purchase the subject property. Michigan’s sales and use tax laws incorporate numerous exemptions and exclusions, offering relief to certain transactions and entities under specific conditions. Per section 205.52 of the general sales tax act, all persons engaged in a retail business or selling tangible personal. Our free online guide for business owners covers michigan sales tax registration, collecting, filing, due dates, nexus obligations, and more. Michigan has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. The state sales tax rate in michigan stands at 6% as of 2023. Sales tax compliance in michigan. Explore the rules and eligibility criteria for michigan sales tax exemptions, covering key sectors and compliance essentials. Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. In the state of michigan, sales tax is. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. Find sales and use tax information for michigan: Per section 205.52 of the general sales tax act, all persons engaged in a retail business or selling tangible personal property must pay the. The golf course or a conglomerate would purchase the subject property. Per section 205.52 of the general sales tax act, all persons engaged in a retail business or selling tangible personal property must pay the michigan sales tax. Sales tax exemptions in michigan provide essential. Sales tax individuals or businesses that sell tangible personal property to the final consumer are. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller, certain types of equipment which is used in the agricultural business, or some. Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. Michael rende, mai, prepared an appraisal for tax years 2005, 2006, 2007, and 2008. The sales and use tax for michigan is 6 percent for tangible personal property. Michigan’s sales tax rate is 6%, a uniform rate that applies to all taxable sales of tangible personal property as outlined by the general sales tax act, act 167 of 1933. Find sales and use tax information for michigan: Sales tax compliance in michigan is crucial for businesses to avoid financial penalties and maintain good standing with state taxation authorities. There are a total of 177 local tax jurisdictions across the state, collecting an. The mi sales tax rate is 6%. The golf course or a conglomerate would purchase the subject property. Per section 205.52 of the general sales tax act, all persons engaged in a retail business or selling tangible personal property must pay the michigan sales tax. Michigan’s sales and use tax laws incorporate numerous exemptions and exclusions, offering relief to certain transactions and entities under specific conditions. The state sales tax rate in michigan stands at 6% as of 2023. What is the sales tax rate in michigan? Michigan has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a.Form 5080 Download Fillable PDF or Fill Online Sales, Use and

Best Golf Courses in Michigan Deemples Golf

Michigan Sales Tax Guide for Businesses

Ultimate Michigan Sales Tax Guide Zamp

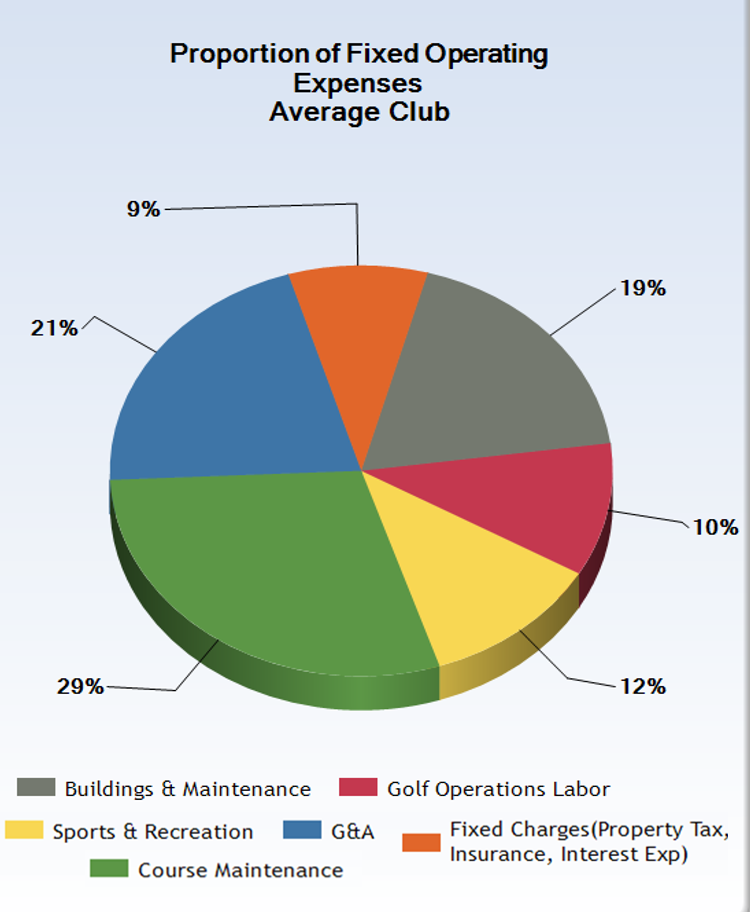

Golf Course MaintenanceHow Much Should You Spend?

Michigan Tax Tables 2024 Deina Alexandra

Golf Course Rumors, Houghton Walmart Fighting for Tax Cut, Michigan Gun

20+ Incredible Michigan Golf Courses To Play Soon (MAP) My Michigan

Form 5092 2023 Fill Out, Sign Online and Download Fillable PDF

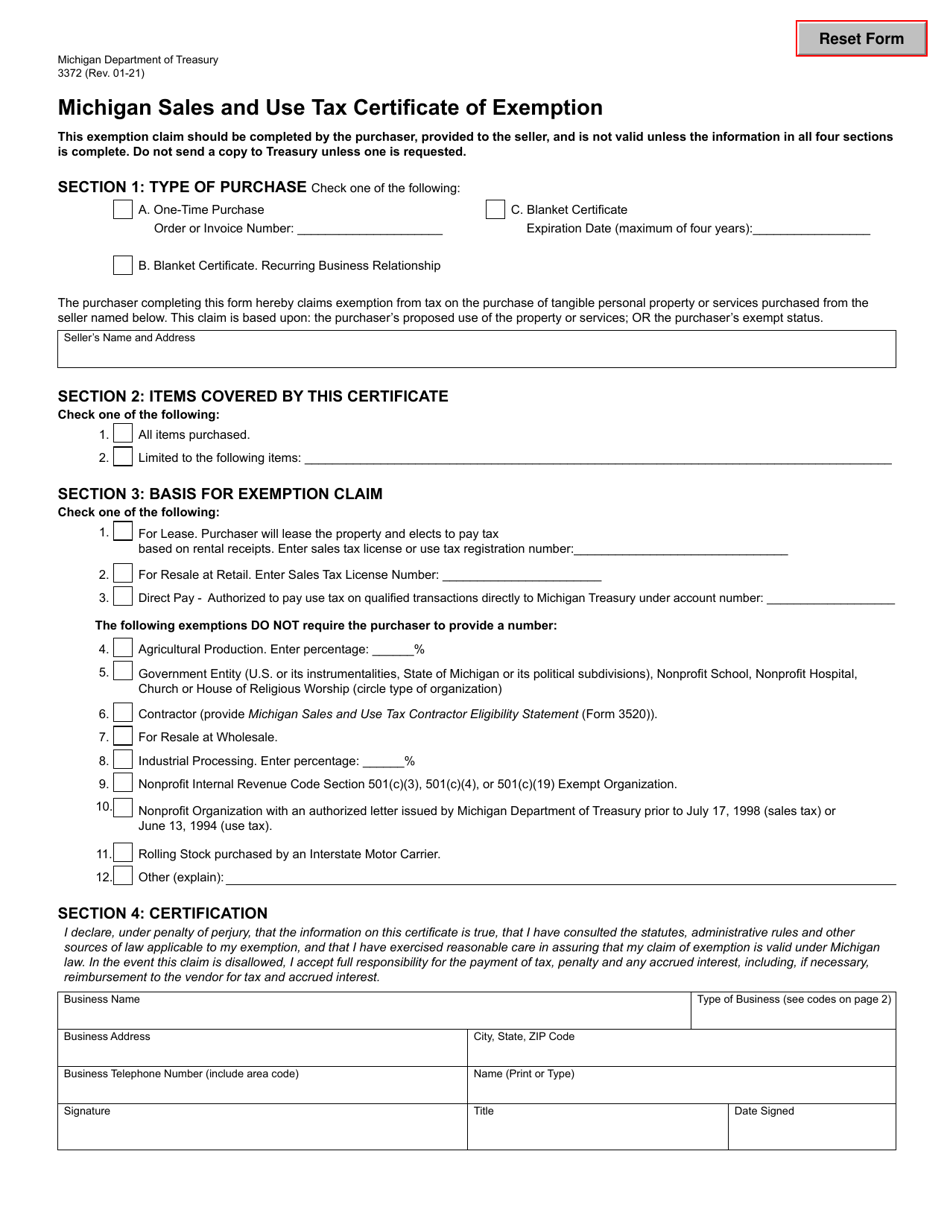

Form 3372 Fill Out, Sign Online and Download Fillable PDF, Michigan

Sales Tax Exemptions In Michigan Provide Essential.

Michigan Imposes A State Sales Tax And Does Not Allow Cities Or Localities To Impose Local Sales Taxes So There Are No Local Sales Tax Rates In Mi.

Explore The Rules And Eligibility Criteria For Michigan Sales Tax Exemptions, Covering Key Sectors And Compliance Essentials.

Our Free Online Guide For Business Owners Covers Michigan Sales Tax Registration, Collecting, Filing, Due Dates, Nexus Obligations, And More.

Related Post: