Irs Enrolled Agent Course

Irs Enrolled Agent Course - Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. A minimum of 16 hours must be earned per year, two of which must be on ethics. What are the webce irs enrolled agent cpe course requirements? Webce ® is registered with the irs as an approved continuing education provider, offering online cpe/ce courses to enrolled agents and tax preparers with active ptins. Obtain a preparer tax identification number (ptin). The irs offers the special enrollment examination (see) to those who want to become enrolled agents. Apply to take the special enrollment exam (see), a standardized national exam. We extract key points of the exam, provide you with exercises, questions and. Here are the steps to earning the ea designation: Discover the enrolled agent course duration, ea exam details, and certification steps. Stay updated with aiimprove your skillslearn chatgpt210,000+ online courses We extract key points of the exam, provide you with exercises, questions and. Pass the special enrollment examination (see) 3. Apply to take the special enrollment exam (see), a standardized national exam. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Pass the special enrollment examination (see) or provide evidence of prior irs experience. Here are the steps to earning the ea designation: Individuals wishing to become an irs enrolled agent must take and pass the special enrollment exam (see). Obtain a preparer tax identification number (ptin) at www.irs.gov/ptin. The irs offers the special enrollment examination (see) to those who want to become enrolled agents. Pass the special enrollment examination (see) 3. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). Pass the special enrollment examination (see) or provide evidence of prior irs experience. Individuals wishing to become. Individuals wishing to become an irs enrolled agent must take and pass the special enrollment exam (see). Obtain a preparer tax identification number (ptin). Learn how to keep your. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Take your career to the next level by becoming an. Apply to take the special enrollment exam (see), a standardized national exam. How do i become an enrolled agent? Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). Candidates may take the three. Stay updated with aiimprove your skillslearn chatgpt210,000+ online courses The irs offers the special enrollment examination (see) to those who want to become enrolled agents. Learn how to become an enrolled agent with our tax school's affordable irs approved online ea exam review courses and continuing education ea tax courses. Here are the steps to earning the ea designation: Webce ® is registered with the irs as an approved. Webce ® is registered with the irs as an approved continuing education provider, offering online cpe/ce courses to enrolled agents and tax preparers with active ptins. Here are the steps to earning the ea designation: Candidates may take the three. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs.. Here are some tips for studying and passing. We extract key points of the exam, provide you with exercises, questions and. Here are the steps to earning the ea designation: Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). Stay updated with aiimprove your skillslearn chatgpt210,000+ online courses Obtain a preparer tax identification number (ptin) at www.irs.gov/ptin. Apply to take the special enrollment exam (see), a standardized national exam. Candidates may take the three. Webce ® is registered with the irs as an approved continuing education provider, offering online cpe/ce courses to enrolled agents and tax preparers with active ptins. Apply to become an enrolled agent, renew your. Here are some tips for studying and passing. Pass the special enrollment examination (see) 3. Obtain a preparer tax identification number (ptin) at www.irs.gov/ptin. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Discover the enrolled agent course duration, ea exam details, and certification steps. Candidates may take the three. We extract key points of the exam, provide you with exercises, questions and. Pass the special enrollment examination (see) or provide evidence of prior irs experience. Apply to take the special enrollment exam (see), a standardized national exam. Learn how to become an enrolled agent with our tax school's affordable irs approved online ea exam. Learn how to keep your. Pass the special enrollment examination (see) 3. Here are the steps to earning the ea designation: Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. Here are some tips for studying and passing. A minimum of 16 hours must be earned per year, two of which must be on ethics. Obtain a preparer tax identification number (ptin) at www.irs.gov/ptin. Apply to take the special enrollment exam (see), a standardized national exam. Webce ® is registered with the irs as an approved continuing education provider, offering online cpe/ce courses to enrolled agents and tax preparers with active ptins. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). What are the webce irs enrolled agent cpe course requirements? We extract key points of the exam, provide you with exercises, questions and. Pass the special enrollment examination (see) 3. Learn how to become an enrolled agent with our tax school's affordable irs approved online ea exam review courses and continuing education ea tax courses. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Take the next step in your tax preparation career, and earn. Discover the enrolled agent course duration, ea exam details, and certification steps. Obtain a preparer tax identification number (ptin). Stay updated with aiimprove your skillslearn chatgpt210,000+ online courses Pass the special enrollment examination (see) or provide evidence of prior irs experience.Enrolled Agent Course Complete IRS Exam Preparation Eduyush

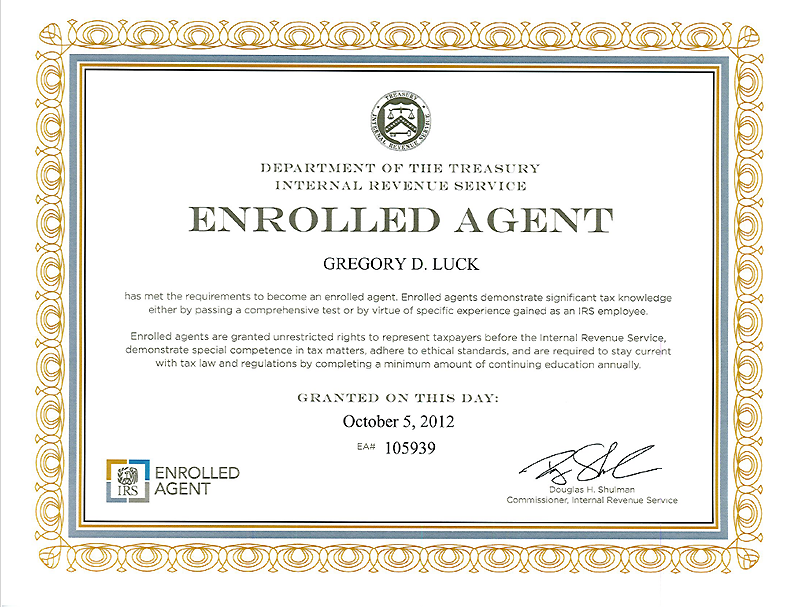

Enrolled Agent (EA) the Complete Kaleidoscope Course, Eligibility

Enrolled Agent Training a Tax (U.S) Representative … Flickr

Enrolled Agent Course Complete IRS Exam Preparation Eduyush

Enrolled Agent Course Complete IRS Exam Preparation Eduyush

Enrolled Agent Course Complete IRS Exam Preparation Eduyush

Enrolled Agent Course Complete IRS Exam Preparation Eduyush

Enrolled Agent Course Complete IRS Exam Preparation Eduyush

Introduction To Prometric (IRS Official EA Exam Bulletin), 41 OFF

EA Course in Kerala Enrolled Agent Training EA Course Fees in India

How Do I Become An Enrolled Agent?

Here Are Some Tips For Studying And Passing.

Learn How To Keep Your.

Candidates May Take The Three.

Related Post: