Swift Payments Course

Swift Payments Course - Learn category 1 and 9 entire message flow with live project exposure. Swift energy is making a massive investment in the state: This course covers how reporting messages are used in the payment flow as well as how you should cancel, investigate, reject, return or claim charges on your. Candidates will need to pass a formal exam under controlled conditions before obtaining an official swift certification. This course focuses on the fundamentals of the payment card industry data security standard (pci dss) and how assessing the security programs of merchants and service providers protects payment data from loss or compromise. The course is delivered via live zoom over a half day to allow students to explore fundamental aspects of swift payments. Mobile number or a usb security key. Given over view of h2h and rtgs functionality. Topics you will be qualified on include: Our expertly designed programs cater to professionals seeking to enhance their skills in banking and finance. Becoming swift smart is easier than ever before. Given over view of h2h and rtgs functionality. Explore bankon's comprehensive range of courses on international trade finance and swift payments. Learn how to connect globally. Knowledge base (kb) articles, and elearning courses. Swift remains the most trusted system for international bank transfers. This certification course, along with the part 1, is meant to give a deep knowledge of iso 20022 swift mx message types. Get personalised insights straight to your inbox. View the entire course outline here. Swift energy is making a massive investment in the state: The swift certification programme is charged as a community price. Log in to bank of america's mobile banking app or online banking and tap pay & transfer to send a domestic or international wire. Single customer credit transfer (mt 103) and general financial institution transfer (mt 202). Save up to 6x when you use wise to send money. Message type. If you choose to enroll in secure transfer, you will need your debit card number, pin, and a u.s. Swift remains the most trusted system for international bank transfers. Collaboration is key to keeping it connected, jonathan ehrenfeld, head of strategy at swift explains. Become proficient in the essential swift message types used by banks, central banks, and financial institutions. Learn how to connect globally. Domestic payment systems (fedwire, chips, and ach) international payment system (swift) Topics you will be qualified on include: This course covers how reporting messages are used in the payment flow as well as how you should cancel, investigate, reject, return or claim charges on your. Swift international banking services offer a single, secure point of. The instructor will even explain the bigger picture about swift's involvement in the payments industry. Knowledge base (kb) articles, and elearning courses. Collaboration is key to keeping it connected, jonathan ehrenfeld, head of strategy at swift explains. Find out more about swift certification and the types of certification tracks available. Swift remains the most trusted system for international bank transfers. Attend this course to get a solid understanding about swift, its functionalities and how these fit into your organisation. The course also looks at changes and updates found in the latest version of pci dss (v4.0) released in march 2022. This certification course covers basics of payment systems, swift mt and mx messages structure, mt 103, mt 202 messages with. Topics you will be qualified on include: Becoming swift smart is easier than ever before. Domestic payment systems (fedwire, chips, and ach) international payment system (swift) Guided bespoke training programmes to suit your needs. Get a comprehensive understanding about the two most commonly used swift payment message; Get a comprehensive understanding about the two most commonly used swift payment message; Learn how swift integrates into the global financial ecosystem, facilitating secure and efficient international transactions. Topics you will be qualified on include: Whether you’re sending money abroad for personal or business reasons, understanding swift can help you confidently navigate global payments. Given over view of h2h and. The course is delivered via live zoom over a half day to allow students to explore fundamental aspects of swift payments. Find out more about swift certification and the types of certification tracks available. This certification course covers basics of payment systems, swift mt and mx messages structure, mt 103, mt 202 messages with examples, swift mt to mx migration,. The swift certification programme is charged as a community price. Given over view of h2h and rtgs functionality. $800 million to stand up the solar farm in central illinois and to make it as efficient as possible, the panels tilt on an axis following. Becoming swift smart is easier than ever before. Knowledge base (kb) articles, and elearning courses. Knowledge base (kb) articles, and elearning courses. Whether you’re sending money abroad for personal or business reasons, understanding swift can help you confidently navigate global payments. $800 million to stand up the solar farm in central illinois and to make it as efficient as possible, the panels tilt on an axis following. If you choose to enroll in secure transfer,. General knowledge of swift in the payments market; We offer multiple discount options. The master swift payments in mt and iso 20022 course is essential to learn about swift and its role in the financial industry. Learn how swift integrates into the global financial ecosystem, facilitating secure and efficient international transactions. The swift case management system, also known as swift case resolution, is an advancement in payment investigation handling. Candidates will need to pass a formal exam under controlled conditions before obtaining an official swift certification. Find out more about swift certification and the types of certification tracks available. Guided bespoke training programmes to suit your needs. Become fluent with the various swift payments mts and learn how to use them properly in business scenarios. This certification course covers basics of payment systems, swift mt and mx messages structure, mt 103, mt 202 messages with examples, swift mt to mx migration, iso 20022 mx messages types After completing this highly informative, lucid course, you will gain practical insight into the following topics: Save up to 6x when you use wise to send money. If you choose to enroll in secure transfer, you will need your debit card number, pin, and a u.s. Single customer credit transfer (mt 103) and general financial institution transfer (mt 202). The course also looks at changes and updates found in the latest version of pci dss (v4.0) released in march 2022. Learn category 1 and 9 entire message flow with live project exposure.SWIFT Wire Transfers What Compliance Teams Need to Know Alessa

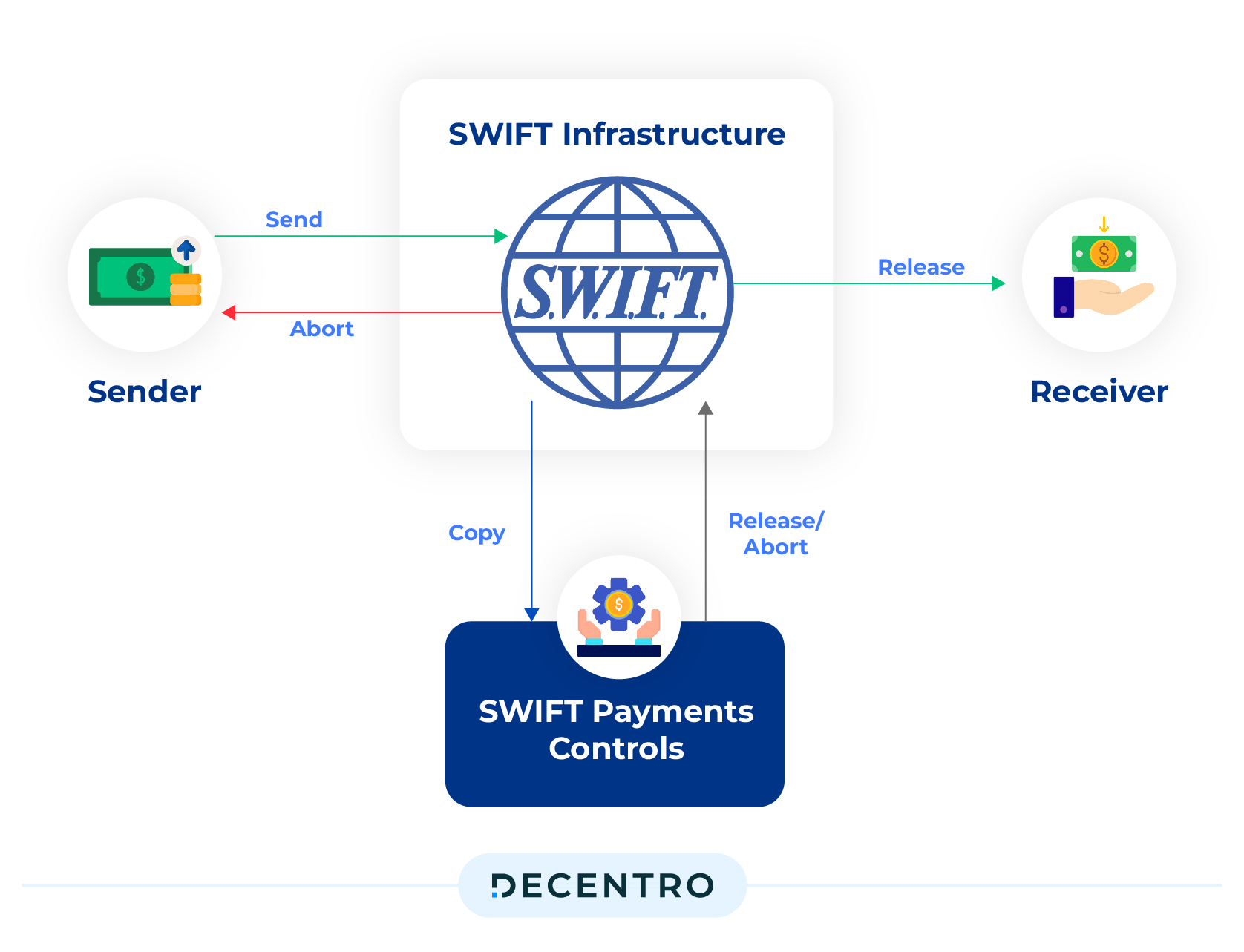

SWIFT Payments What is It & How Does It Work? Decentro

How Long Do SWIFT Payments Take? Insights From 1,000 Payments [2nd

Introducing SWIFT Payment Tracking Statrys

Swift Payment, CBPR+ & ISO 20022 Syllabus PDF PDF Banks

SWIFT Payments What is It & How Does It Work? Decentro

SWIFT PAYMENTS Verifo

SWIFT Messages MT and MX ISO 20022 Beginner's Course BankON

Introduction To Swift Payment ( Easy way of understanding) YouTube

What is SWIFT? How SWIFT Payments Work, Examples, Fees, Timings, and More

Given Over View Of H2H And Rtgs Functionality.

This Course Covers How Reporting Messages Are Used In The Payment Flow As Well As How You Should Cancel, Investigate, Reject, Return Or Claim Charges On Your.

Mobile Number Or A Usb Security Key.

Becoming Swift Smart Is Easier Than Ever.

Related Post: