Tax Equity Modeling Course

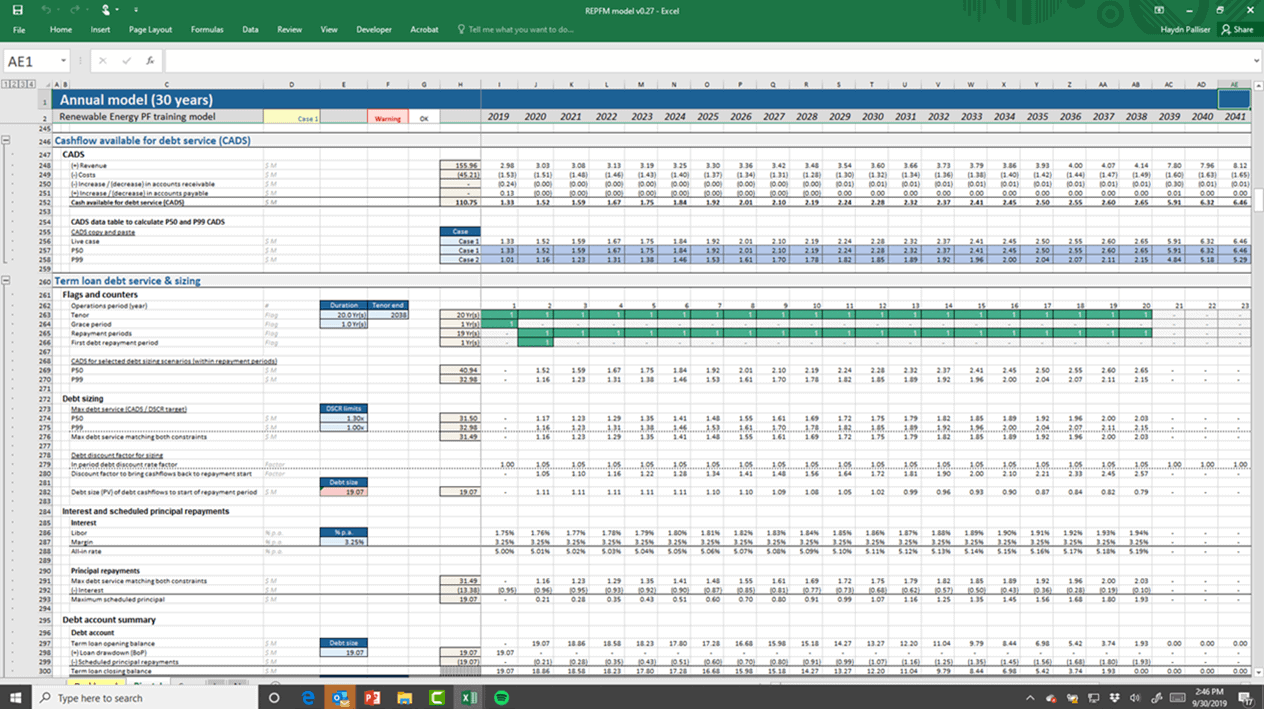

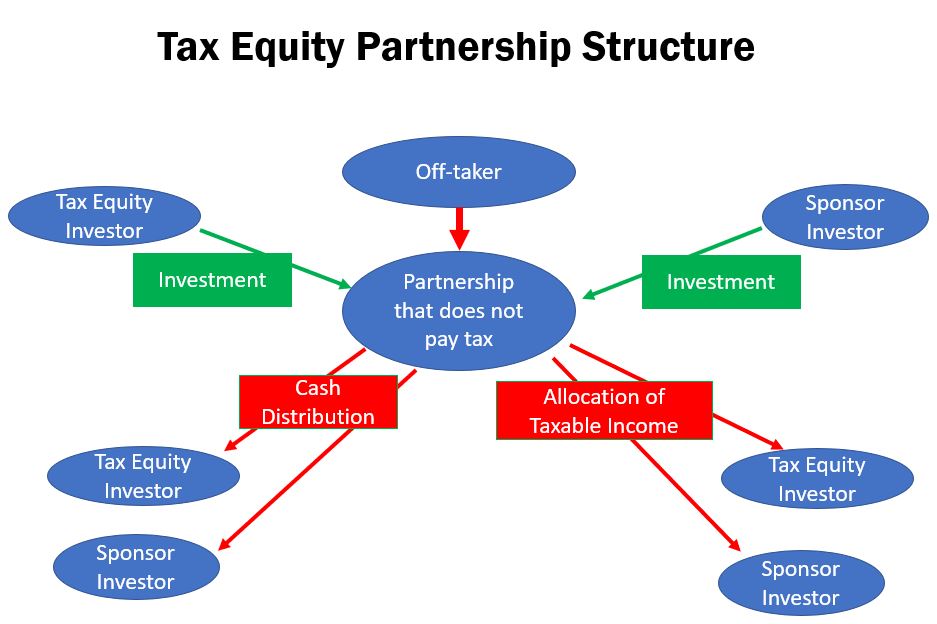

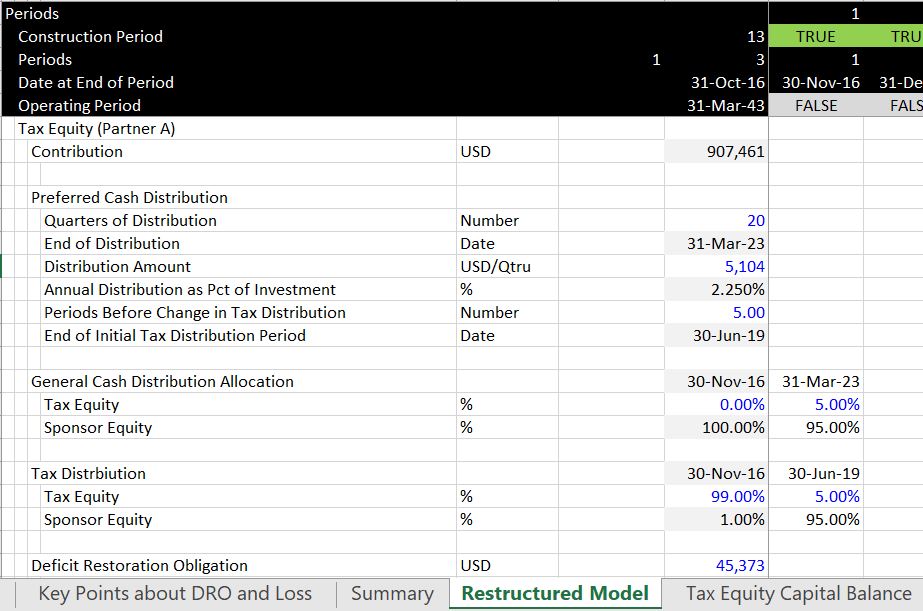

Tax Equity Modeling Course - This page includes files and videos for a course on tax equity modelling. Enroll in course to unlock. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. Develop best practice techniques in order to calculate and analyse returns at. Renewable energy investments, with a focus on the development of a. This is an intensive course providing an overview of the tax equity structures commonly used in u.s. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. Whether you’re an investor, analyst, or developer, our training. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Whether you’re an investor, analyst, or developer, our training. Enroll in course to unlock. Enroll in course to unlock. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Develop best practice techniques in order to calculate and analyse returns at. Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. Recognize drivers and structure of tax equity transactions; Each listing includes the course number,. 6 schools | 4 courses. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. Recognize drivers and structure of tax equity transactions; Enroll in course to unlock. This page includes files and videos for a course on tax equity modelling. Each listing includes the course number,. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. By the end of this course, you. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. 6 schools | 4 courses. Financial modeling & corporate valuation, 3. Enroll in course to unlock. By the end of this course, you. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Pivotal180 offers self paced online training to learn project. 6 schools | 4 courses. Financial modeling & corporate valuation, 3. By the end of this course, you. Enroll in course to unlock. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. This page includes files and videos for a course on tax equity modelling. Financial modeling and valuation, 2. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Recognize drivers and structure of tax equity transactions; Financial. Enroll in course to unlock. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. By the end of this course, you. Financial modeling & corporate valuation, 3. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Recognize drivers and structure of tax equity transactions; Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. Develop best practice techniques in order to calculate. By the end of this course, you. Whether you’re an investor, analyst, or developer, our training. Renewable energy investments, with a focus on the development of a. Financial modeling & corporate valuation, 3. 6 schools | 4 courses. And, finally, in the fourth part, we will review the peculiarities of the us renewable projects and build a financial model that takes into account the tax credits available in the us, and. Develop best practice techniques in order to calculate and analyse returns at. The course begins with some fundamental modelling with some exercises on creating a time based. Financial modeling & corporate valuation, 3. Renewable energy investments, with a focus on the development of a. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Develop best. This is an intensive course providing an overview of the tax equity structures commonly used in u.s. Renewable energy investments, with a focus on the development of a. Financial modeling & corporate valuation, 3. Pivotal180’s tax equity financial modeling course provides an overview of the tax equity structures commonly used in u.s. Renewable energy investments, with a focus on the development of a. Pivotal180 offers self paced online training to learn project finance financial modeling from ivy league professors. 6 schools | 4 courses. Each listing includes the course number,. Following is a list of courses approved by the department grouped alphabetically by provider and numerically by course number within the provider. Whether you’re an investor, analyst, or developer, our training. This page includes files and videos for a course on tax equity modelling. Develop best practice techniques in order to calculate and analyse returns at. Subscribe to learning210,000+ online coursesstart learning todaystay updated with ai Master project finance, tax equity modeling, and renewable energy financial structuring with pivotal180. Enroll in course to unlock. The course begins with some fundamental modelling with some exercises on creating a time based flip and a yield.What is a Tax Equity Flip Structure? Financial Modeling for Renewable

DCF Model Training The Ultimate Free Guide to DCF Models

Tax Equity Model Familiarization Video Pivotal180

Capital Accounts in Tax Equity Financial Modeling for Renewable

Exercises for Modelling Tax Equity Edward Bodmer Project and

Yield Based Flip and Partnership Allocation (Generally for Wind

Tax Equity Model with Fixed Flip Date (Generally for Solar Projects

Modeling Investment Tax Credit for Solar Projects in US (Tax Equity

Tax Equity Financing and Waterfall Modelling Part 1 YouTube

Financial Modeling for Tax Equity Introduction to the Course YouTube

Financial Modeling And Valuation, 2.

And, Finally, In The Fourth Part, We Will Review The Peculiarities Of The Us Renewable Projects And Build A Financial Model That Takes Into Account The Tax Credits Available In The Us, And.

Recognize Drivers And Structure Of Tax Equity Transactions;

Enroll In Course To Unlock.

Related Post: